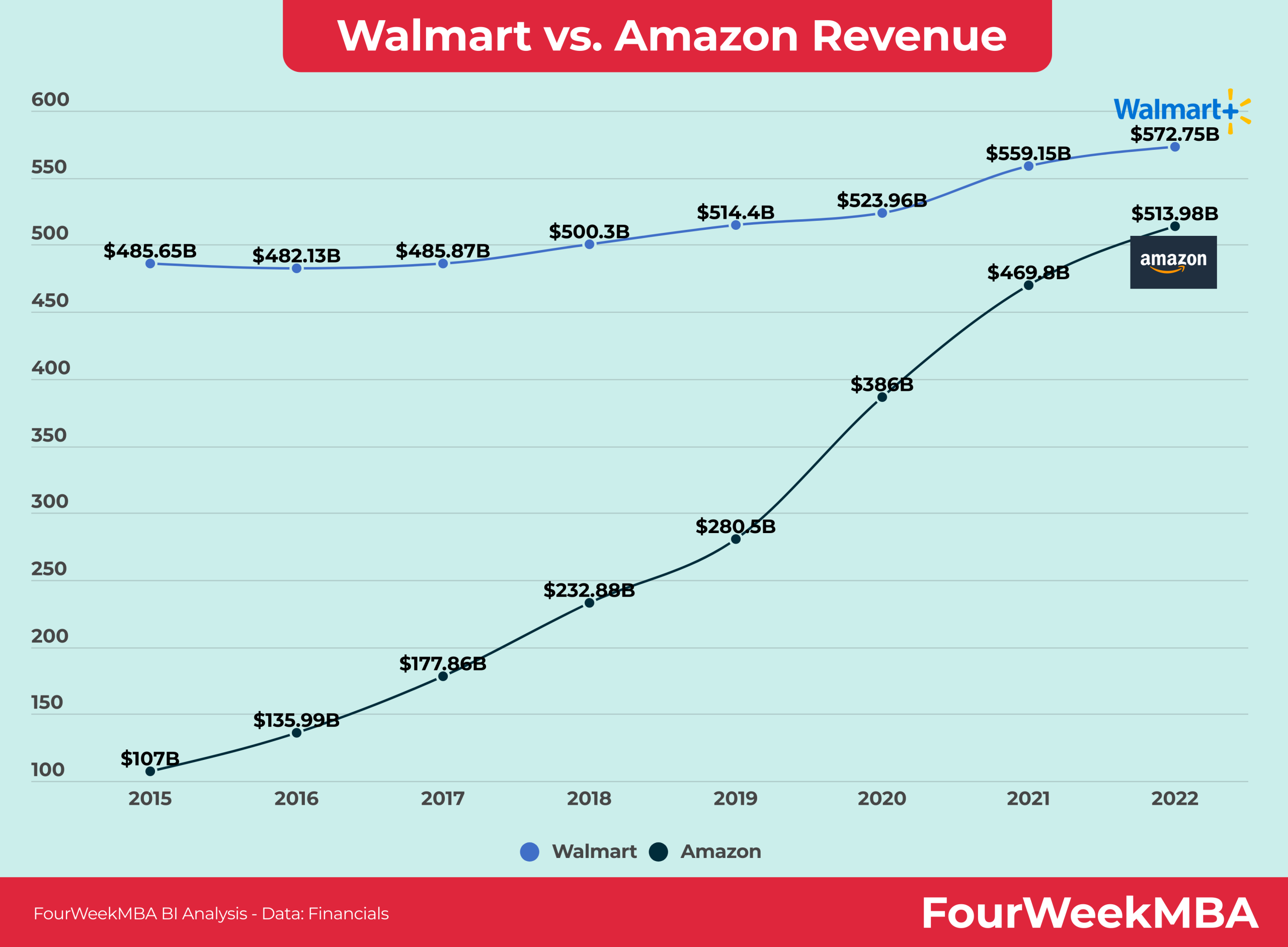

Amazon Vs Walmart Fourweekmba Amazon and walmart have both seen strong financial growth in the last few years. walmart brought in $573 billion in revenue in 2022, an increase from $559.15 billion in 2021. in the first quarter. Walmart reigns supreme in brick and mortar retail, while amazon dominates e commerce. both retailers set themselves apart by doing more than selling merchandise. they also generate.

Amazon Vs Walmart Competitive Analysis 2020 Walmart and amazon have transformed retail through a decades long rivalry fueling aggressive innovations that benefit consumers. as we enter 2023, how do these very different retail giants stack up against each other? this in depth analysis examines their performance across key metrics. The consensus estimates project amazon’s net income to increase to $63 billion in 2025 and $79 billion in 2026, compared to walmart’s projected net income of $22 billion in 2025 and $24 billion in 2026. walmart’s retail is profitable, but aws greatly boosts amazon’s overall profits. Walmart and amazon embody two distinct approaches to meeting consumer needs—one rooted in physical stores and the other in digital convenience. their rivalry not only influences consumer behavior but also sets trends that redefine retail practices. These benchmarks underscore how focusing on constantly measuring meaningful performance data, with the capability to make changes to your tactics and strategy as that data indicates, is the bottom line for success on both amazon and walmart.

Amazon Vs Walmart Competitive Analysis Walmart and amazon embody two distinct approaches to meeting consumer needs—one rooted in physical stores and the other in digital convenience. their rivalry not only influences consumer behavior but also sets trends that redefine retail practices. These benchmarks underscore how focusing on constantly measuring meaningful performance data, with the capability to make changes to your tactics and strategy as that data indicates, is the bottom line for success on both amazon and walmart. According to the american customer satisfaction index, amazon rated higher than the other companies with a score of 83% (acsi). on the other hand, walmart joined the survey in 2018 and scored 74% making it to the bottom 8th of the list. As the retail landscape continues to evolve at a staggering pace, the rivalry between two colossal giants, walmart and amazon, intensifies. dubbed ‘the 2024 retail race,’ this showdown demands a comprehensive analysis to understand the current standing and future projections of the retail industry. Amazon and walmart's rivalry shapes retail's future with omnichannel strategies, tech reliance, and customer centric approaches driving their impressive q4 2024 growth. For many years, amazon has dominated the ecommerce world, performing much better than all of its competitors. but 2024 was different: walmart is no longer flying under the radar and is getting more attention from marketers. but how big is it really? looking at sales, amazon is still miles ahead.