Double Declining Balance Ddb Assignment Point The double declining balance (ddb) depreciation method, also known as the method of balance, is one of two traditional methods that a company uses to account for the value of a long lived asset. The double declining balance (ddb) depreciation method, also known as the reducing balance method, is one of two common methods a business uses to account for the expense of a long lived.

Double Declining Balance Ddb Depreciation Method Definition The double declining balance method (ddb) is a form of accelerated depreciation in which the annual depreciation expense is greater during the earlier stages of the fixed asset’s useful life. Learn how to use the double declining balance method, using the ddb balance depreciation formula and calculator for accelerated depreciation. depreciate fixed assets using ddb or straight line method. What is the double declining balance method? the double declining balance method, often referred to as the ddb method, is a commonly used accounting technique to calculate the depreciation of an asset. The double declining balance (ddb) method is notable for its accelerated approach to asset depreciation, impacting a company’s reported earnings and tax liabilities by front loading depreciation expenses.

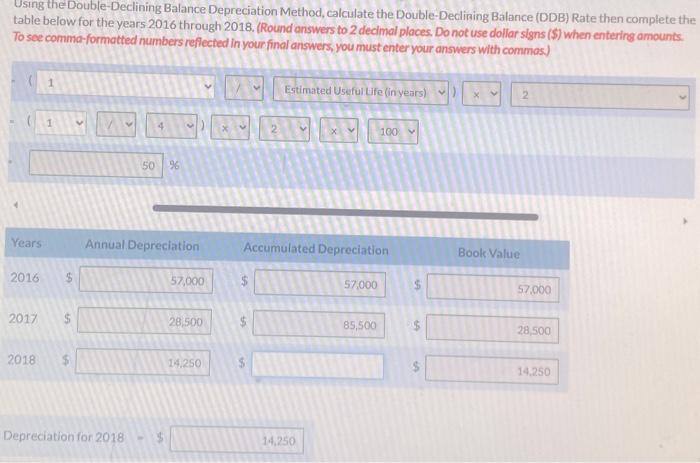

Using The Double Declining Balance Depreciation Chegg What is the double declining balance method? the double declining balance method, often referred to as the ddb method, is a commonly used accounting technique to calculate the depreciation of an asset. The double declining balance (ddb) method is notable for its accelerated approach to asset depreciation, impacting a company’s reported earnings and tax liabilities by front loading depreciation expenses. Start by computing the ddb rate, which remains constant throughout the useful life of the fixed asset. however, depreciation expense in the succeeding years declines because we multiply the ddb rate by the undepreciated basis, or book value, of the asset. read on for our step by step guide. Before choosing the double declining balance (ddb) method to determine depreciable basis, there are several factors to consider. the ddb method is a commonly used depreciation method that allows for accelerated depreciation in the early years of an asset's life. The double declining balance (ddb) depreciation method is an accelerated depreciation technique commonly used in accounting and finance to allocate the cost of a tangible asset over its useful life. Understanding and applying the double declining balance (ddb) depreciation method is essential for financial professionals seeking to match asset expense with usage more accurately, optimize tax strategies (where permitted), and present realistic asset valuations in financial statements.