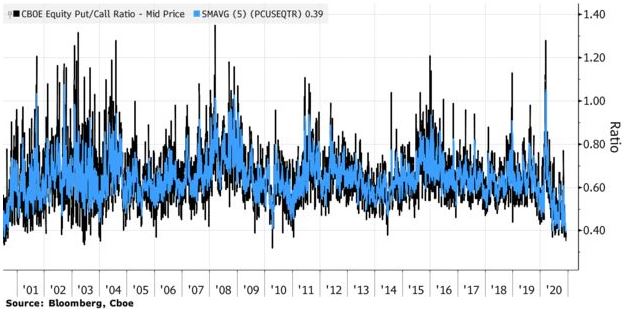

Irrational Exuberance Eric Kim Irrational exuberance is widespread and undue economic optimism. when investors start believing that the rise in prices in the recent past predicts the future, they are acting as if there is no uncertainty in the market, causing a positive feedback loop of ever higher prices. Hey folks, i’m will larson! i wrote an elegant puzzle, staff engineer, the engineering executive’s primer, and crafting engineering strategy. you might also be interested in my collection of popular blog posts over the years, or to read my writing as it’s published via my newsletter or my rss feed. what can agents actually do? july 6, 2025.

Irrational Exuberance Download Irrational exuberance represents a departure from rational investment behavior, often leading to market bubbles and crashes. by examining its causes and manifestations, we can better prepare for and potentially mitigate its effects on the economy. This article explores the concept of irrational exuberance and its impact on financial markets. delving into historical examples like the dot com and housing bubbles, it examines the psychological factors influencing investor behavior, such as herd mentality and confirmation bias. Explore the concept of irrational exuberance in financial markets, including its causes, impact on institutional investors, and real life case studies like the dotcom bubble. What is irrational exuberance? irrational exuberance occurs when the investors exhibiting high excitement and interest go for the purchase of an asset based on its current high performance without considering its intrinsic value.

Irrational Exuberance Fivars Explore the concept of irrational exuberance in financial markets, including its causes, impact on institutional investors, and real life case studies like the dotcom bubble. What is irrational exuberance? irrational exuberance occurs when the investors exhibiting high excitement and interest go for the purchase of an asset based on its current high performance without considering its intrinsic value. Irrational exuberance irrational exuberance refers to investor enthusiasm that drives asset prices higher than those assets' fundamentals justify. read more. Irrational exuberance can be defined as a state of heightened optimism and enthusiasm that drives investors to bid up asset prices beyond their intrinsic value. this behavior often leads to unsustainable price bubbles, which eventually burst, causing significant market corrections. By analyzing these events, investors and policymakers can better recognize the signs of irrational exuberance and take steps to mitigate the risks associated with asset price bubbles. The below sections will summarize chapters 4, 5, and 6 from irrational exuberance. the emergence and evolution of speculative bubbles in financial markets is intricately tied to the history and role of the news media.

Irrational Exuberance Ino Trader S Blog Irrational exuberance irrational exuberance refers to investor enthusiasm that drives asset prices higher than those assets' fundamentals justify. read more. Irrational exuberance can be defined as a state of heightened optimism and enthusiasm that drives investors to bid up asset prices beyond their intrinsic value. this behavior often leads to unsustainable price bubbles, which eventually burst, causing significant market corrections. By analyzing these events, investors and policymakers can better recognize the signs of irrational exuberance and take steps to mitigate the risks associated with asset price bubbles. The below sections will summarize chapters 4, 5, and 6 from irrational exuberance. the emergence and evolution of speculative bubbles in financial markets is intricately tied to the history and role of the news media.

Irrational Exuberance Ino Trader S Blog By analyzing these events, investors and policymakers can better recognize the signs of irrational exuberance and take steps to mitigate the risks associated with asset price bubbles. The below sections will summarize chapters 4, 5, and 6 from irrational exuberance. the emergence and evolution of speculative bubbles in financial markets is intricately tied to the history and role of the news media.

Irrational Exuberance Ino Trader S Blog