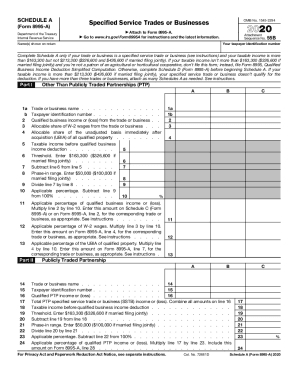

Fillable Online Fillable Online 2021 Schedule D Form 8995 A Special A Schedule C is not the same as a 1099 form Although, you may need IRS Form 1099 (a 1099-NEC or 1099-K in particular) to fill out a Schedule C Best Overall Tax Software The Internal Revenue Service (IRS) has released updated Schedule B tax form instructions and printable forms for the tax years 2023 and 2024 TRAVERSE CITY, MI, US, January 3, 2024 /EINPresswire

Fillable Online Form 8995 A Schedule A Fax Email Print Pdffiller Schedule A (Form 1040 or 1040-SR) is an IRS form for US taxpayers who choose to itemize their tax-deductible expenses rather than take the standard deduction The Purpose of the IRS W-4 Form How to Fill Out a W4 Form Form W-8 Form W-9 1040 Forms Form 1040 These subtotals from Form 8949 are then transferred to Schedule D of your Form 1040, New Form 4506-B and Revised Form 4506-A Exempt Organizations (EO) has developed and released a new Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter (PDF) New online fillable tax forms will become available for download by the Internal Revenue Service (IRS) for the 2023 and 2024 tax years TRAVERSE CITY, MI, US, January 22, 2024 /EINPresswirecom

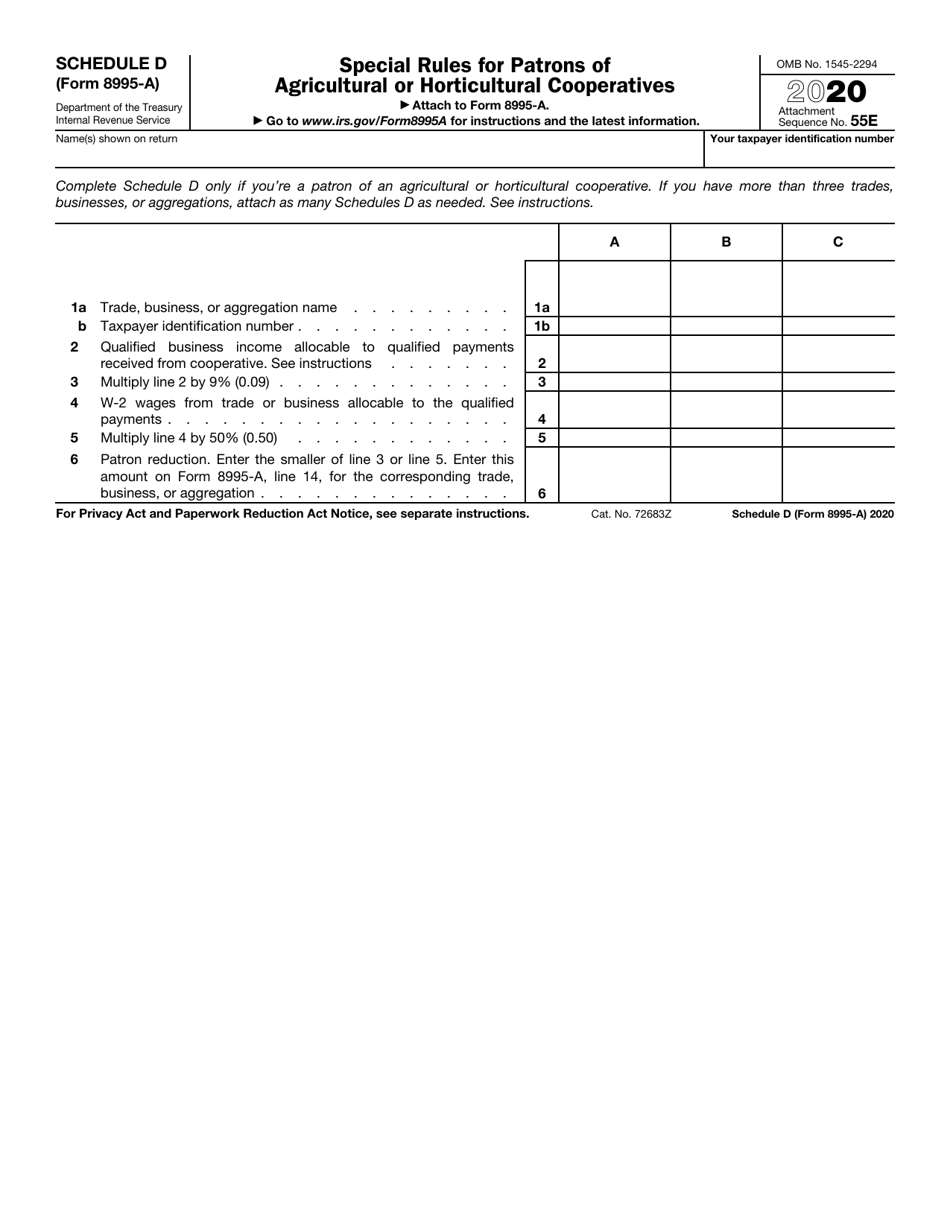

Irs Form 8995 A Schedule D Download Fillable Pdf Or Fill Online Special New Form 4506-B and Revised Form 4506-A Exempt Organizations (EO) has developed and released a new Form 4506-B, Request for a Copy of Exempt Organization IRS Application or Letter (PDF) New online fillable tax forms will become available for download by the Internal Revenue Service (IRS) for the 2023 and 2024 tax years TRAVERSE CITY, MI, US, January 22, 2024 /EINPresswirecom Form 1099-DIV is an IRS form sent by banks and other financial institutions to investors who receive dividends and distributions from investments during a calendar year Skip to content News Form 1099-R is an IRS tax form used to report distributions from annuities, profit-sharing plans, retirement plans, or insurance contracts Form 8949: Sales and Other Dispositions of Capital Assets is an Internal Revenue Service tax form used to report capital gains and losses from investments Just six (or so) months after the Internal Revenue Service (IRS) released the much talked about - and maligned - form 1040 for the 2018 tax year, there’s a new draft in town Here’s a quick

Irs Form 8995 2022 Federal 8995 Tax Form Pdf Instructions For Form 1099-DIV is an IRS form sent by banks and other financial institutions to investors who receive dividends and distributions from investments during a calendar year Skip to content News Form 1099-R is an IRS tax form used to report distributions from annuities, profit-sharing plans, retirement plans, or insurance contracts Form 8949: Sales and Other Dispositions of Capital Assets is an Internal Revenue Service tax form used to report capital gains and losses from investments Just six (or so) months after the Internal Revenue Service (IRS) released the much talked about - and maligned - form 1040 for the 2018 tax year, there’s a new draft in town Here’s a quick Schedule A is an IRS form used to claim itemized deductions on a tax return (Form 1040) See how to fill it out, how to itemize tax deductions and helpful tips IRS Form 1065, US Return of Schedule B, Other Information, If your partnership has more than 100 partners, you are required to fill out the form online The Bottom Line