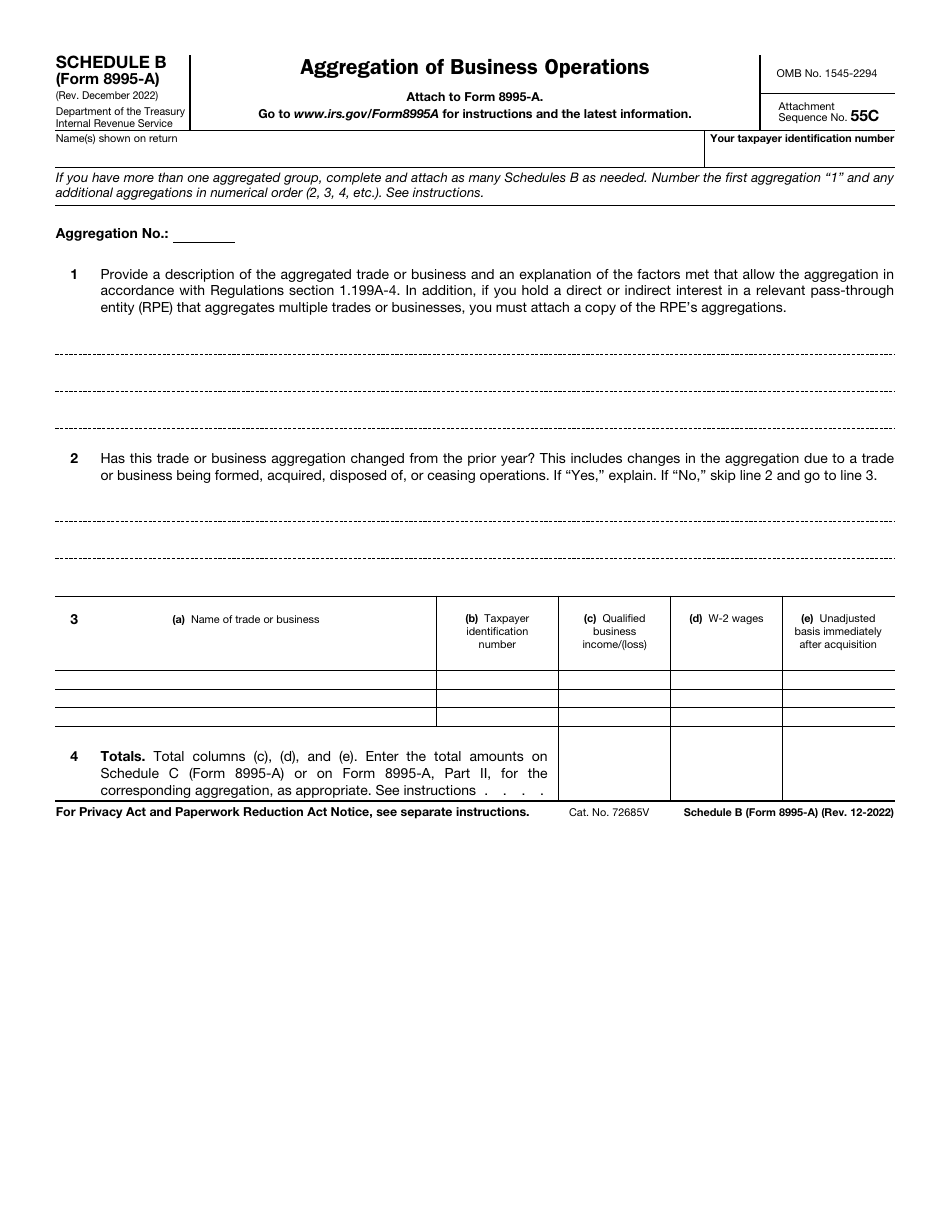

Irs Form 8995 A Schedule B Download Fillable Pdf Or Fill Online Schedule b (form 8995 a)—aggregation of business operations if you qualify and choose to aggregate multiple trades or businesses into a single trade or business, you must complete schedule b before starting part i. Here are links to articles and videos we've created about other tax forms and schedules mentioned in this video or its accompanying article: irs form 8995 a, qualified business income deduction.

Irs Form 8995 A Schedule B Download Fillable Pdf Or Fill Online We'll report the qbi deduction for your combined businesses on form 8995 a (deduction for qualified business income) with schedule b (aggregation of business operations). Provide a description of the aggregated trade or business and an explanation of the factors met that allow the aggregation in accordance with regulations section 1.199a 4. The aggregation must be disclosed every year on an attached statement to the return (provided in form 8995 a, schedule b). once an aggregation has been formed, it must remain consistent from year to year and may not be disaggregated unless there is a significant change in facts and circumstances. Schedule b of form 8995 a provides instructions for accurately aggregating business operations, which is crucial for tax filing. by following the guidelines outlined in schedule b, taxpayers can ensure that they aggregate their business operations correctly.

Irs Form 8995 Walkthrough Qbi Deduction Simplified 57 Off The aggregation must be disclosed every year on an attached statement to the return (provided in form 8995 a, schedule b). once an aggregation has been formed, it must remain consistent from year to year and may not be disaggregated unless there is a significant change in facts and circumstances. Schedule b of form 8995 a provides instructions for accurately aggregating business operations, which is crucial for tax filing. by following the guidelines outlined in schedule b, taxpayers can ensure that they aggregate their business operations correctly. Provide a description of the aggregated trade or business and an explanation of the factors met that allow the aggregation in accordance with regulations section 1.199a 4. For tax year 2018 the irs has provided, in publication 535, business expenses, that the proper method for disclosing aggregations is “schedule b — aggregation of business operations” for that publication’s qbi deduction worksheet. The schedule b aggregation of business operations worksheet is automatically included as a statement with the e filing of the tax return. the lacerte options to auto generate and attach pdfs to e files should be set to yes for this to occur. Aggregation no.: 1 provide a description of the aggregated trade or business and an explanation of the factors met that allow the aggregation in accordance with regulations section 1.199a 4.