Irs Form 8995 Walkthrough Qbi Deduction Simplified 57 Off Information about form 8995, qualified business income deduction simplified computation, including recent updates, related forms and instructions on how to file. use form 8995 to figure your qualified business income deduction. Subscribe to our channel: channel ucpqfix80n8 a3mc6gx9if2g?sub confirmation=1 subscribe to our newsletter: tinyurl.c.

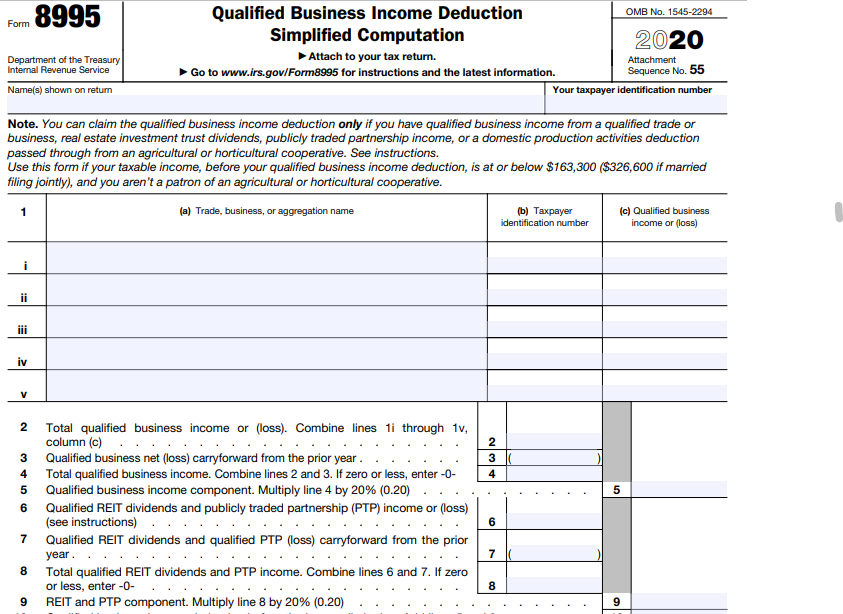

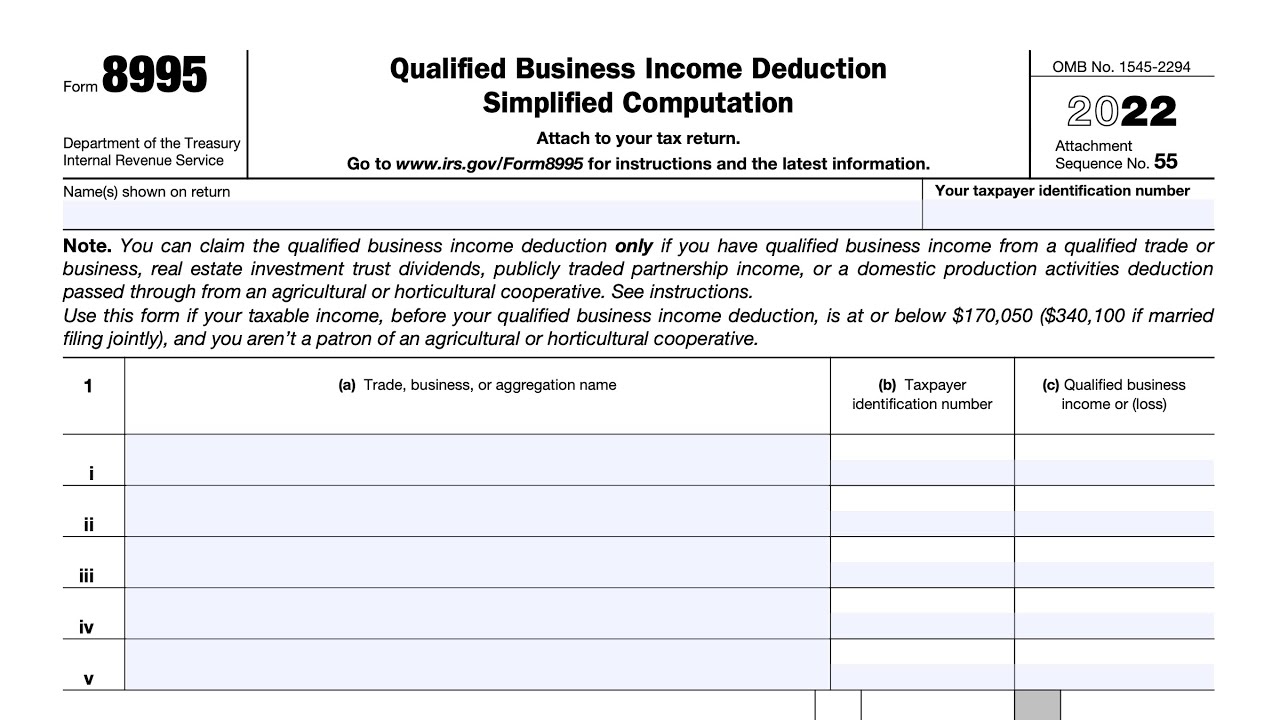

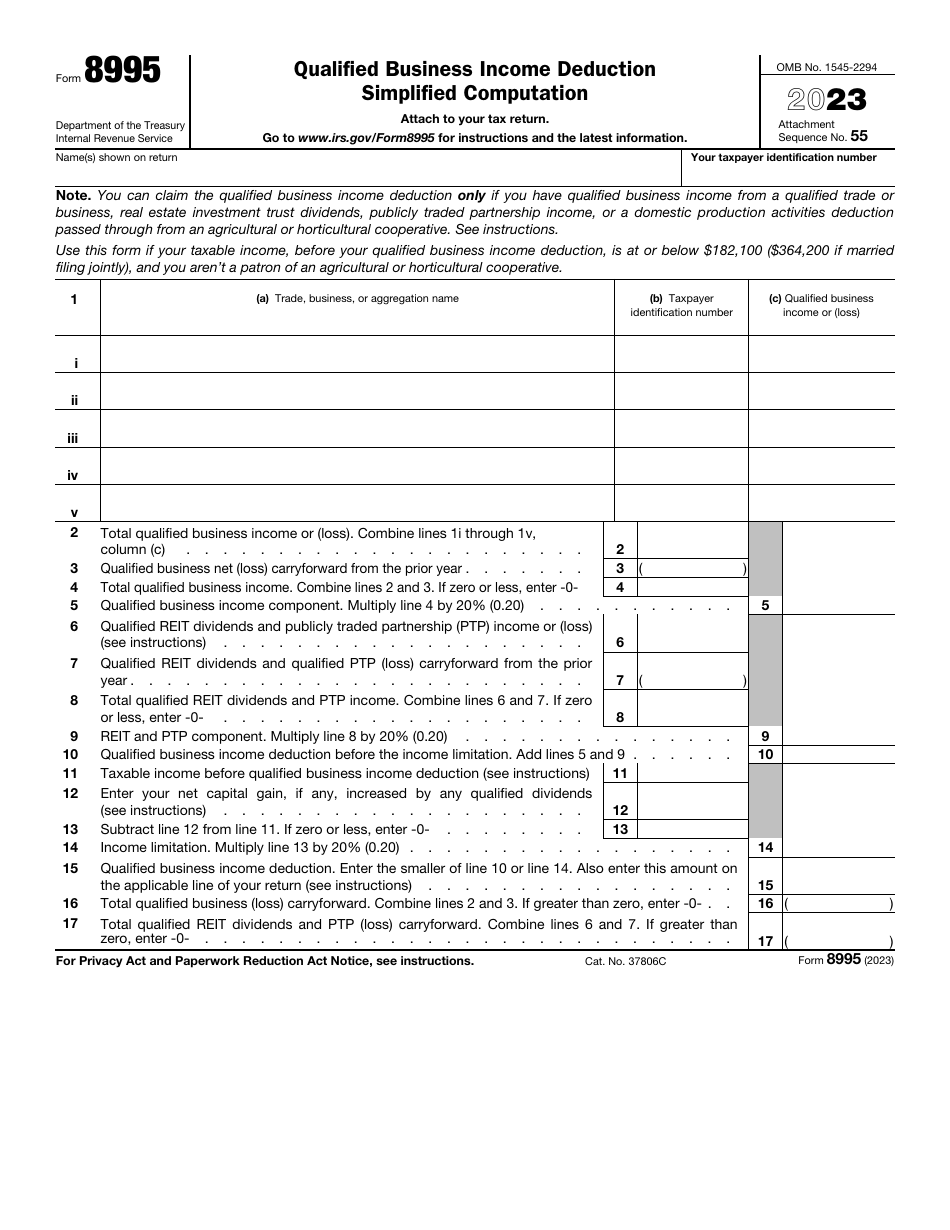

Irs Form 8995 Walkthrough Qbi Deduction Simplified 57 Off In 2018, the tax cuts and jobs act (tcja) introduced a new type of tax deduction for businesses operating as pass through entities: the qualified business income deduction, or qbi. this article walks you through how to use irs form 8995 to determine: whether you are eligible to take the qbi deduction on your federal income tax return. Irs form 8995 is a tax document used by eligible taxpayers to calculate their qualified business income (qbi) deduction. this deduction, also known as the section 199a deduction, allows owners of certain pass through businesses to deduct up to 20% of their qualified business income. Form 8995 plays a critical role in maximizing tax savings for eligible individuals and businesses by allowing them to deduct a portion of their qbi. understanding the eligibility criteria, common mistakes, and proper filing procedures can significantly impact your tax outcomes. What is form 8995 and how does it simplify the qbi deduction? form 8995 is an irs tax form that some taxpayers use to calculate the qualified business income (qbi) deduction. it’s designed for those whose qbi is less than the threshold amount, making the calculation simpler than using form 8995.

Irs Form 8995 Walkthrough Qbi Deduction Simplified 57 Off Form 8995 plays a critical role in maximizing tax savings for eligible individuals and businesses by allowing them to deduct a portion of their qbi. understanding the eligibility criteria, common mistakes, and proper filing procedures can significantly impact your tax outcomes. What is form 8995 and how does it simplify the qbi deduction? form 8995 is an irs tax form that some taxpayers use to calculate the qualified business income (qbi) deduction. it’s designed for those whose qbi is less than the threshold amount, making the calculation simpler than using form 8995. Simplified tax filing: for those under the income threshold, it streamlines qbid calculations. potential tax savings: claiming up to 20% of qbi as a deduction can significantly reduce taxable income. What is form 8995 and how does it simplify the qbi deduction? form 8995, also known as the qualified business income (qbi) simplified computation, is an irs tax form used by eligible taxpayers to calculate their qbi deduction if their income is below a certain threshold. Curious about what is form 8995? this guide explains how to claim the qbi deduction. reduce your business’s taxable income and maximize savings. Form 8995, also known as the qualified business income deduction simplified computation form, is used to calculate and claim the 20% qbi deduction. the deduction applies to pass through entities, including: if your taxable income is below a certain threshold, you can use form 8995 to claim the deduction without complex calculations.

Irs Form 8995 Download Fillable Pdf Or Fill Online Qualified Business Simplified tax filing: for those under the income threshold, it streamlines qbid calculations. potential tax savings: claiming up to 20% of qbi as a deduction can significantly reduce taxable income. What is form 8995 and how does it simplify the qbi deduction? form 8995, also known as the qualified business income (qbi) simplified computation, is an irs tax form used by eligible taxpayers to calculate their qbi deduction if their income is below a certain threshold. Curious about what is form 8995? this guide explains how to claim the qbi deduction. reduce your business’s taxable income and maximize savings. Form 8995, also known as the qualified business income deduction simplified computation form, is used to calculate and claim the 20% qbi deduction. the deduction applies to pass through entities, including: if your taxable income is below a certain threshold, you can use form 8995 to claim the deduction without complex calculations.