Payment Tokenization Explained Riset Learn how tokenized securities work, what can be tokenized, and how fintech teams can meet us and global compliance requirements. Payment tokenization is a security technique that replaces sensitive payment information, such as credit card numbers, with a unique, random set of characters called a “token.”.

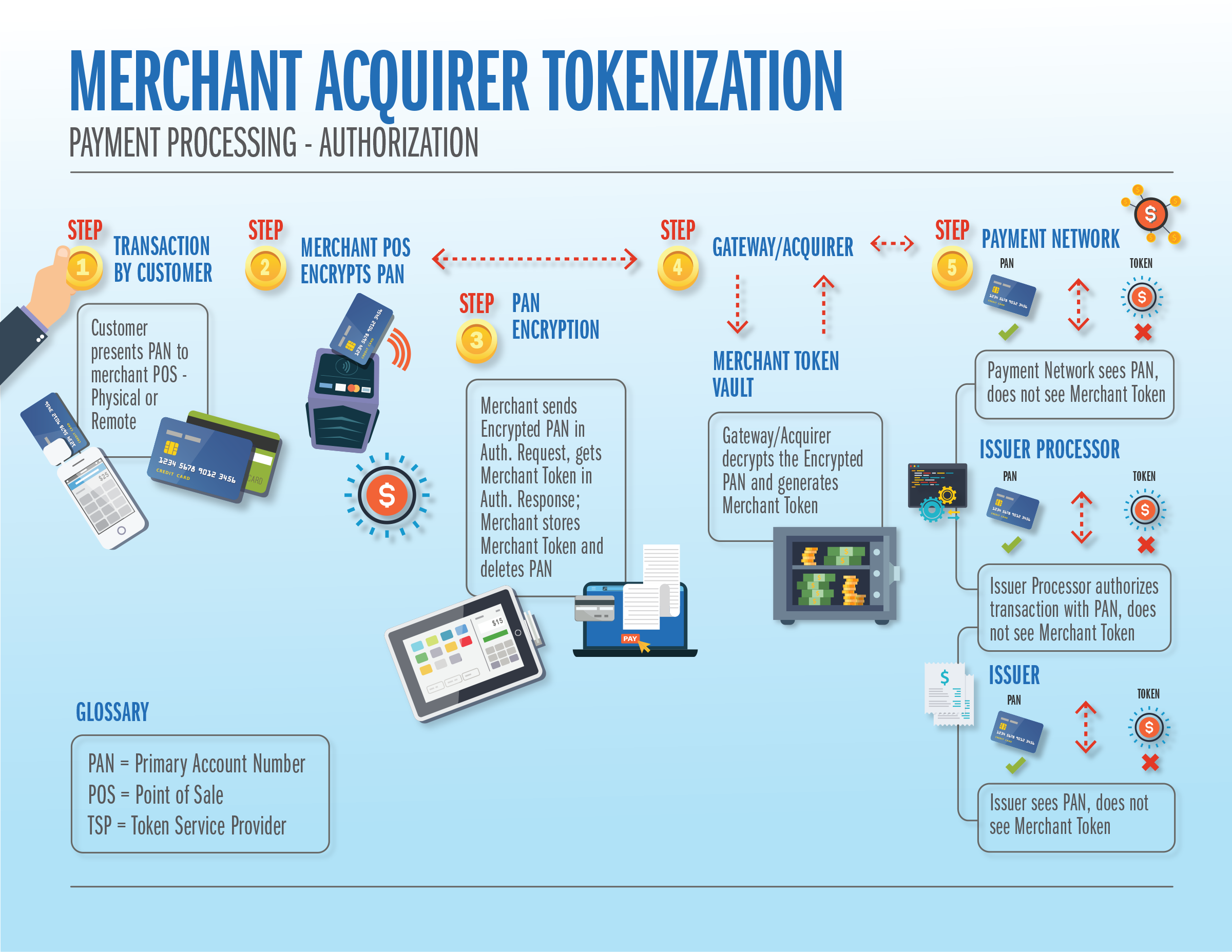

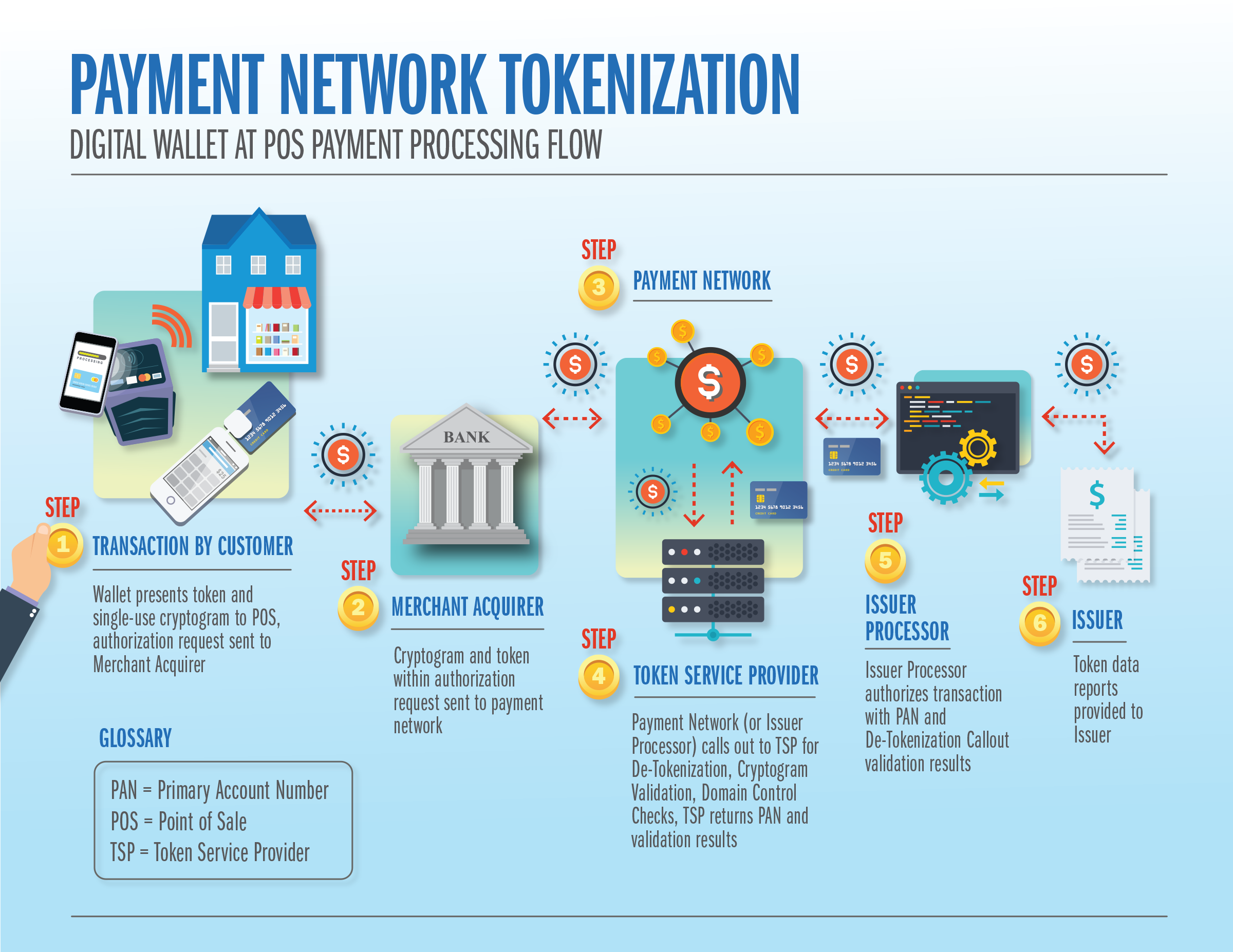

Payment Tokenization Explained Riset In payments, tokenization involves substituting cardholder data (chd), such as a primary account number (pan), with a unique string of characters or numbers known only to the tokenization system. this means no sensitive information about the card or the customer is used or stored by the merchant. Payment tokenization is a data security process that replaces sensitive payment information, such as credit card numbers, with a unique identifier or " token." [1]. Payment tokenization is the process of replacing sensitive information with a randomly generated string of characters or symbols, i.e, tokens, to reduce the likelihood of fraud or breach. Tokenization is what makes many online and digital wallet purchases possible. it enables safer, faster one click payments, reduces fraud, and boosts authorization rates – while sending abandoned cart rates in the opposite direction. but what is payment tokenization, exactly – and how does it work?.

Whenthen Blog Payment Tokenization Explained Riset Payment tokenization is the process of replacing sensitive information with a randomly generated string of characters or symbols, i.e, tokens, to reduce the likelihood of fraud or breach. Tokenization is what makes many online and digital wallet purchases possible. it enables safer, faster one click payments, reduces fraud, and boosts authorization rates – while sending abandoned cart rates in the opposite direction. but what is payment tokenization, exactly – and how does it work?. Payment tokenization is the process of turning sensitive credit card data into a unique identifier known as a token that has no meaning on its own. it keeps payment data out of fraudsters’ hands and gives customers more convenient payment experiences by powering technology like mobile and e wallets. Payment tokenization is a security process that modifies sensitive payment information, such as credit card numbers, with a unique, randomly generated token. this token acts as a stand in for the original data, allowing transactions to be processed without exposing actual financial details. Payment tokenization secures payment data by replacing it with tokens. a token is a random string of characters. it holds no meaningful information. if someone steals the token, they can’t use it to get the original data. by using tokens, businesses don’t store actual digital payment details. Tokenization is a security process that replaces sensitive payment information, such as credit card numbers, with randomized tokens that are meaningless outside of the payment system. here’s how it works in a typical transaction: a customer enters their card details at checkout.