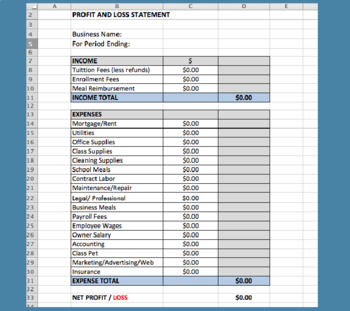

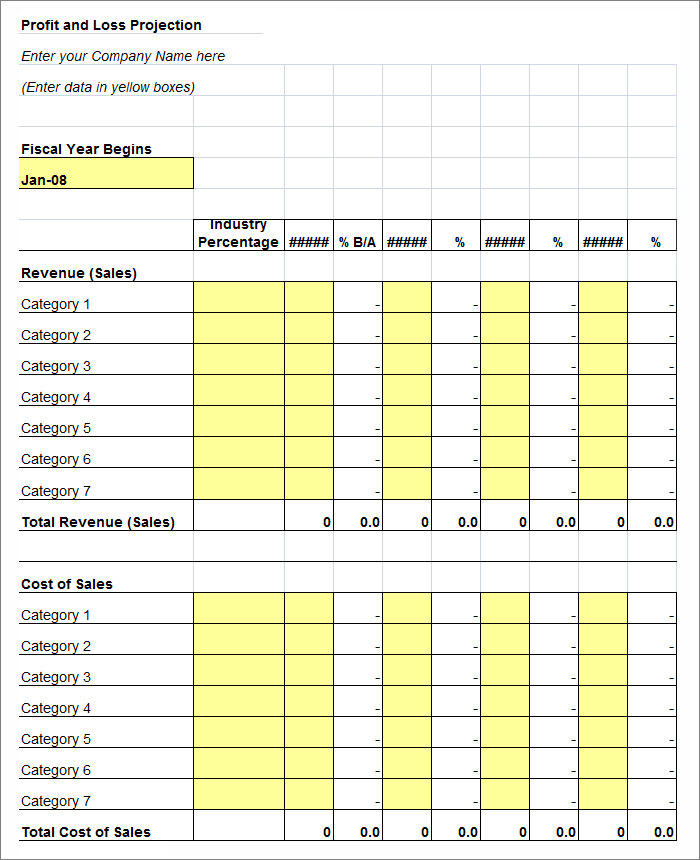

Profit And Loss Statement Bookkeeping Template For Administrators Gross profit is what a business earns after deducting all of its costs of goods sold (cogs). operating profit is the money it earns from its day to day activities and excludes interest and. The meaning of profit is a valuable return : gain. how to use profit in a sentence.

Profit And Loss Statement Bookkeeping Template For Administrators Profit is the financial benefit realized when the revenue a business generates exceeds its costs, including operational expenses, administrative costs, and the taxes involved in the maintenance of business activities. Profit is when revenue is greater than costs. businesses try to maximize profit, also known as the "profit motive." it also drives the stock market. Profit is the money earned by a business when its total revenue exceeds its total expenses. any profit a company generates goes to its owners, who may choose to distribute the money to shareholders as income, or allocate it back into the business to finance further company growth. In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. [1] . it is equal to total revenue minus total cost, including both explicit and implicit costs. [2].

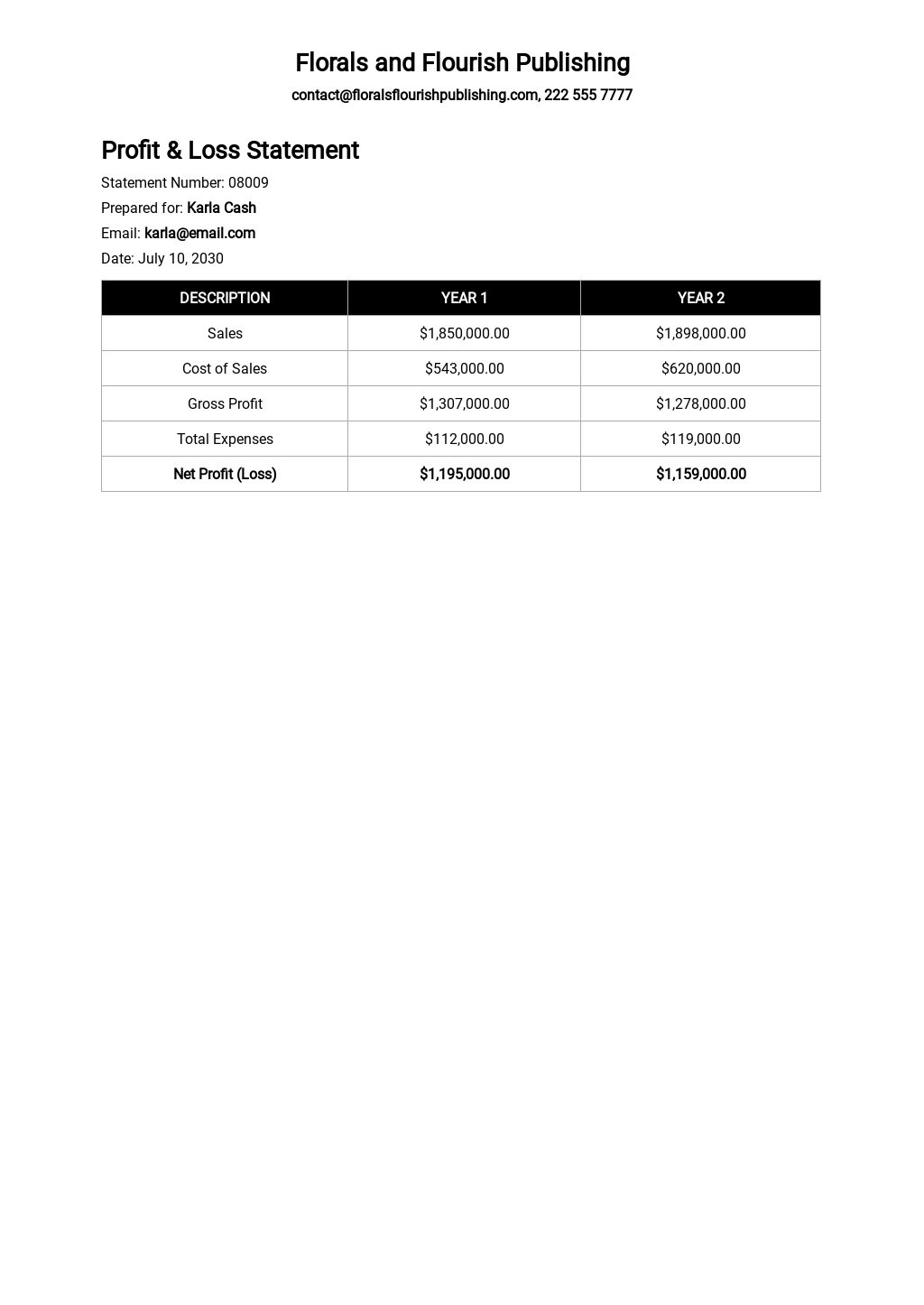

Profit And Loss Statement Profit is the money earned by a business when its total revenue exceeds its total expenses. any profit a company generates goes to its owners, who may choose to distribute the money to shareholders as income, or allocate it back into the business to finance further company growth. In economics, profit is the difference between revenue that an economic entity has received from its outputs and total costs of its inputs, also known as surplus value. [1] . it is equal to total revenue minus total cost, including both explicit and implicit costs. [2]. Profit is the financial gain a business realizes when its revenue surpasses its expenses. it serves as the reward for taking risks, innovating, and efficiently managing resources, acting as a crucial indicator of a company’s health and potential for growth. in the simplest terms, profit is what’s left over after a business pays all its bills. Profit is a critical financial metric for businesses, indicating how well a company generates income after covering all expenses. this article explains what profit is, and delves into the three main types of profit: gross, operating, and net profit. There are three common measures of profit: 1. gross profit. gross profit is the value that remains after the cost of sales, or cost of goods sold (cogs), has been deducted from sales revenue. this is typically the first sub total on the income statement for most businesses. 2. operating profit. Profit, in business usage, the excess of total revenue over total cost during a specific period of time. in economics, profit is the excess over the returns to capital, land, and labour (interest, rent, and wages).

11 Profit And Loss Statements Word Pdf Google Docs Apple Pages Profit is the financial gain a business realizes when its revenue surpasses its expenses. it serves as the reward for taking risks, innovating, and efficiently managing resources, acting as a crucial indicator of a company’s health and potential for growth. in the simplest terms, profit is what’s left over after a business pays all its bills. Profit is a critical financial metric for businesses, indicating how well a company generates income after covering all expenses. this article explains what profit is, and delves into the three main types of profit: gross, operating, and net profit. There are three common measures of profit: 1. gross profit. gross profit is the value that remains after the cost of sales, or cost of goods sold (cogs), has been deducted from sales revenue. this is typically the first sub total on the income statement for most businesses. 2. operating profit. Profit, in business usage, the excess of total revenue over total cost during a specific period of time. in economics, profit is the excess over the returns to capital, land, and labour (interest, rent, and wages).

7 Free Profit And Loss Statement Templates Edit Download There are three common measures of profit: 1. gross profit. gross profit is the value that remains after the cost of sales, or cost of goods sold (cogs), has been deducted from sales revenue. this is typically the first sub total on the income statement for most businesses. 2. operating profit. Profit, in business usage, the excess of total revenue over total cost during a specific period of time. in economics, profit is the excess over the returns to capital, land, and labour (interest, rent, and wages).