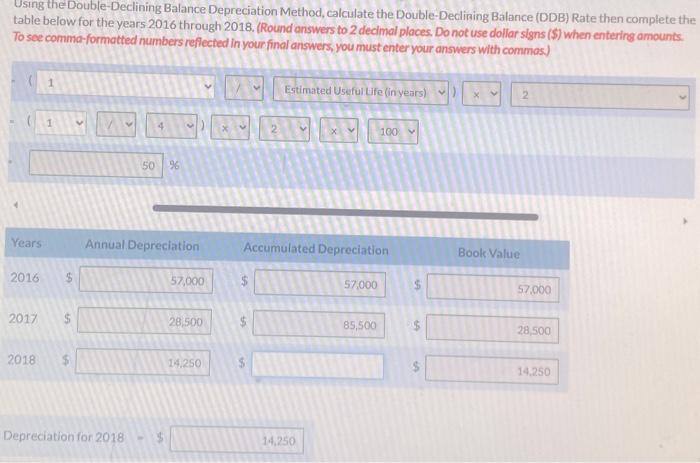

Using The Double Declining Balance Depreciation Chegg Double declining balance depreciation calculate depreciation for the following asset using double declining balance depreciation: truck, cost $24,000, salvage $2.000. Calculate depreciation of an asset using the double declining balance method and create and print depreciation schedules. calculator for depreciation at a declining balance factor of 2 (200% of straight line). includes formulas, example, depreciation schedule and partial year calculations.

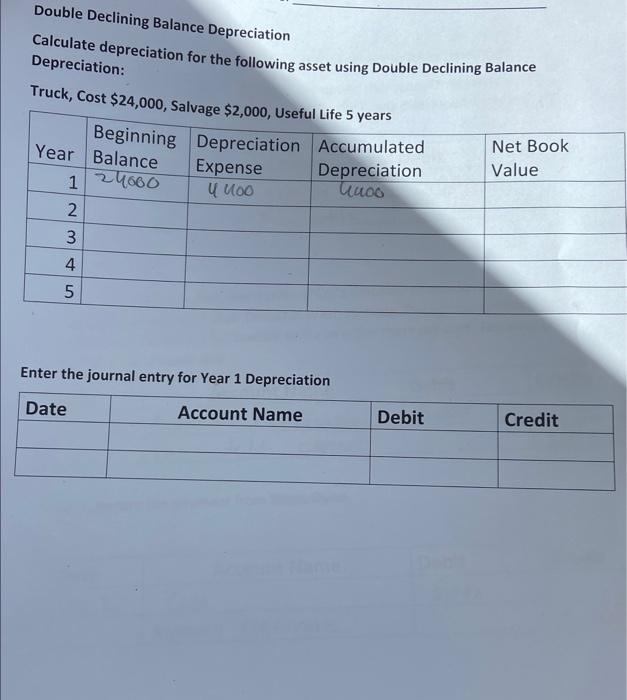

Solved Double Declining Balance Depreciation Calculate Chegg The double declining balance method (ddb) describes an approach to accounting for the depreciation of fixed assets where the depreciation expense is greater in the initial years of the asset’s assumed useful life. A double declining balance method is a form of an accelerated depreciation method in which the asset value is depreciated at twice the rate it is done in the straight line method. A double declining depreciation calculator helps businesses and individuals determine the depreciation expense of an asset using the double declining balance method. After inputting all of the information, the double declining depreciation calculator will automatically generate the book value year start, depreciation percent, depreciation expense, accumulated depreciation, and the book value year end for four years.

Solved How Do They Calculate The Double Declining Balance Chegg A double declining depreciation calculator helps businesses and individuals determine the depreciation expense of an asset using the double declining balance method. After inputting all of the information, the double declining depreciation calculator will automatically generate the book value year start, depreciation percent, depreciation expense, accumulated depreciation, and the book value year end for four years. Here's a step by step guide on how to calculate ddb: determine the straight line depreciation rate. this is calculated by dividing 1 by the useful life of the asset. for example, if an asset has a useful life of 5 years, the straight line depreciation rate would be 1 5 = 0.2 or 20%. double the straight line depreciation rate. There are 2 steps to solve this one. double declining balance method is a type of accelerated depreciation method. not the question you’re looking for? post any question and get expert help quickly. The double declining balance method is a method used to depreciate the value of an asset over time. it is a form of accelerated depreciation, which means that the asset depreciates at a faster rate than it would under a straight line depreciation method. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples. and if you want to avoid the spreadsheet headaches altogether, doola bookkeeping can help you manage depreciation automatically and stay tax compliant, without lifting a finger.

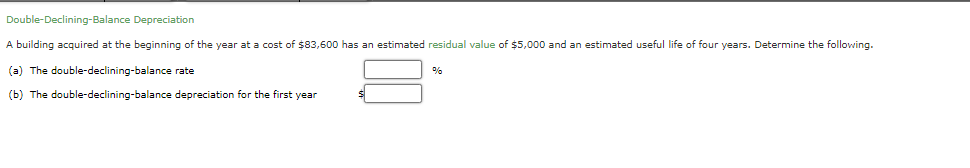

Solved Double Declining Balance Depreciation A ï The Chegg Here's a step by step guide on how to calculate ddb: determine the straight line depreciation rate. this is calculated by dividing 1 by the useful life of the asset. for example, if an asset has a useful life of 5 years, the straight line depreciation rate would be 1 5 = 0.2 or 20%. double the straight line depreciation rate. There are 2 steps to solve this one. double declining balance method is a type of accelerated depreciation method. not the question you’re looking for? post any question and get expert help quickly. The double declining balance method is a method used to depreciate the value of an asset over time. it is a form of accelerated depreciation, which means that the asset depreciates at a faster rate than it would under a straight line depreciation method. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples. and if you want to avoid the spreadsheet headaches altogether, doola bookkeeping can help you manage depreciation automatically and stay tax compliant, without lifting a finger.

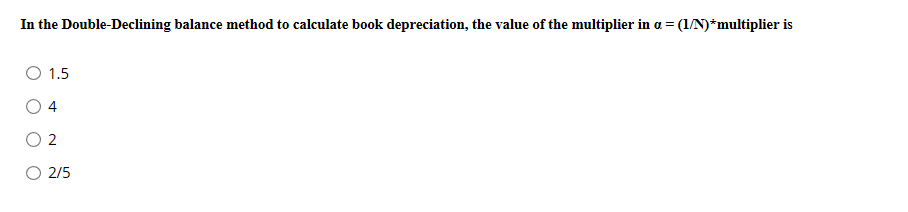

Solved In The Double Declining Balance Method To Calculate Chegg The double declining balance method is a method used to depreciate the value of an asset over time. it is a form of accelerated depreciation, which means that the asset depreciates at a faster rate than it would under a straight line depreciation method. In this guide, we’ll explain how the double declining balance method works in simple terms, compare it with other depreciation methods, and provide step by step examples. and if you want to avoid the spreadsheet headaches altogether, doola bookkeeping can help you manage depreciation automatically and stay tax compliant, without lifting a finger.

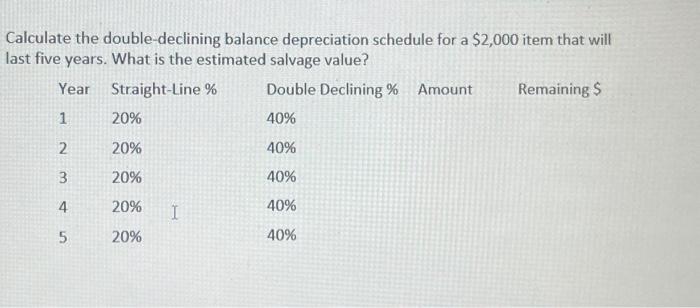

Solved Calculate The Double Declining Balance Depreciation Chegg