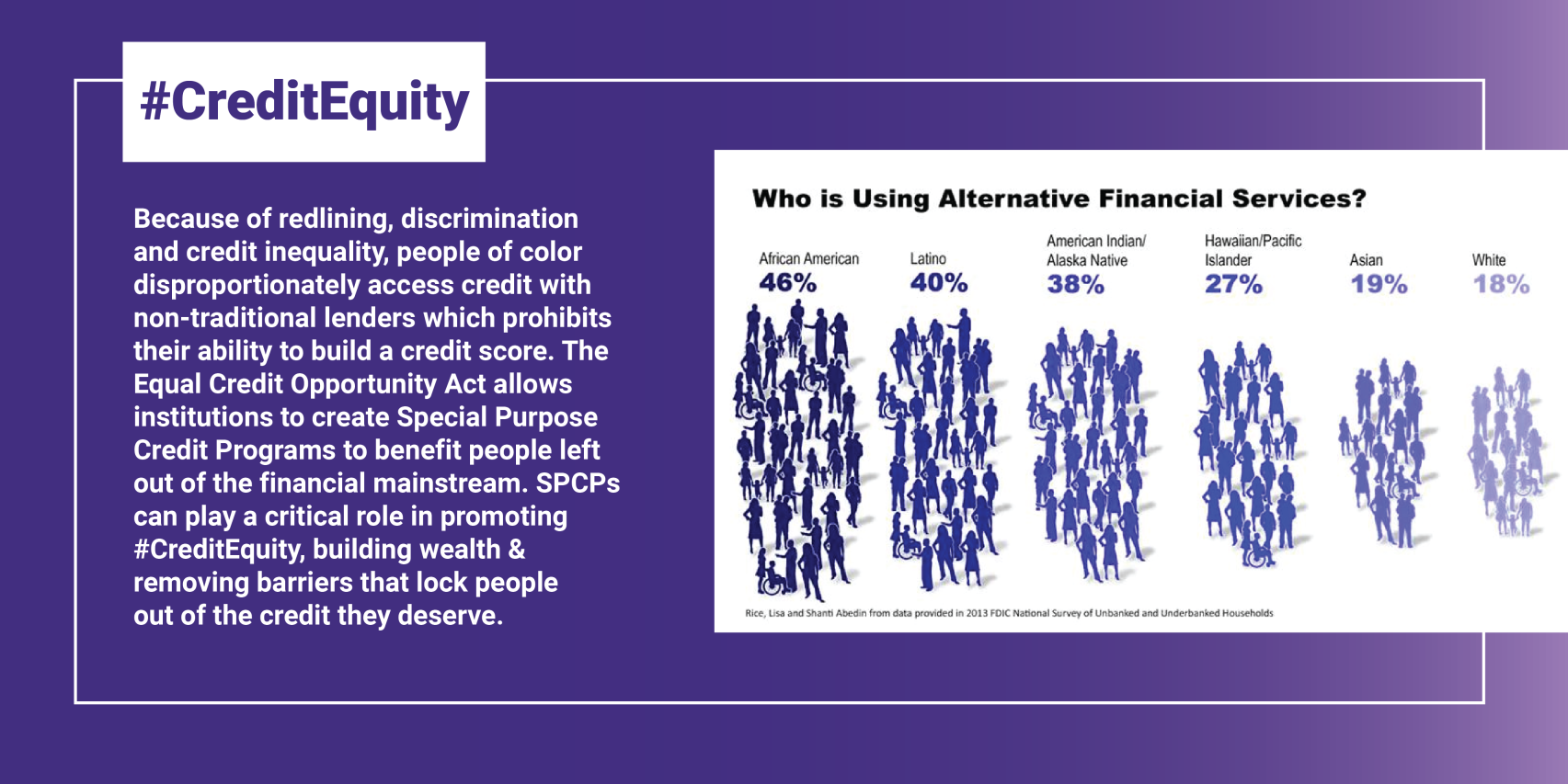

Banks Expanding Special Purpose Credit Programs American Banker Lending institutions that create spcps are required, under the ecoa, to design and administer their programs according to a “written plan” supported by broad analysis and robust data. this ensures the programs are tailored to the specific needs they aim to address. In this report, we conduct an example market analysis to demonstrate the types of data that could be included in a written plan for an spcp, using down payment assistance as the example credit product.

Fillable Online Using Special Purpose Credit Programs To Expand Please join us on wednesday, march 27, 2024 as we introduce a brand new data resource for lending institutions. we’ll walk through the data toolkit, introduce how it can be used to create a written plan, and illustrate the requirements as outlined in the regulations. Special purpose credit programs: using data to create the written plan 3 27 24 national fair housing alliance 915 subscribers subscribed. On december 21, 2020, the cfpb issued an advisory opinion (ao) on special purpose credit programs to clarify the content that a for profit organization must include in a written plan that establishes and administers a special purpose credit program under regulation b. In partnership with the national fair housing alliance, the urban institute created this resource to help lenders document the need for spcps.

Using Special Purpose Credit Programs To Expand Equality Nfha On december 21, 2020, the cfpb issued an advisory opinion (ao) on special purpose credit programs to clarify the content that a for profit organization must include in a written plan that establishes and administers a special purpose credit program under regulation b. In partnership with the national fair housing alliance, the urban institute created this resource to help lenders document the need for spcps. In partnership with the national fair housing alliance, the urban institute created this resource to help lenders document the need for spcps. Using data to design special purpose credit programs a broad market analysis for arizona, california, and nevada john walsh jun zhu. This toolkit is intended to facilitate mortgage lenders as they take on the process of considering and building special purpose credit programs. the toolkit provides examples of spcps from leading banks as well as other examples of spcps in the market. Specific guardrails for spcps. for example, the official staff commentary to regulation b states that a written plan establishing a for profit spcp must “contain information that supports the need for the particular program,” and it must “either state a specific period of time for which the program will last, or contain a statement.

Using Special Purpose Credit Programs To Expand Equality Nfha In partnership with the national fair housing alliance, the urban institute created this resource to help lenders document the need for spcps. Using data to design special purpose credit programs a broad market analysis for arizona, california, and nevada john walsh jun zhu. This toolkit is intended to facilitate mortgage lenders as they take on the process of considering and building special purpose credit programs. the toolkit provides examples of spcps from leading banks as well as other examples of spcps in the market. Specific guardrails for spcps. for example, the official staff commentary to regulation b states that a written plan establishing a for profit spcp must “contain information that supports the need for the particular program,” and it must “either state a specific period of time for which the program will last, or contain a statement.

Special Purpose Credit Program Webinar This toolkit is intended to facilitate mortgage lenders as they take on the process of considering and building special purpose credit programs. the toolkit provides examples of spcps from leading banks as well as other examples of spcps in the market. Specific guardrails for spcps. for example, the official staff commentary to regulation b states that a written plan establishing a for profit spcp must “contain information that supports the need for the particular program,” and it must “either state a specific period of time for which the program will last, or contain a statement.