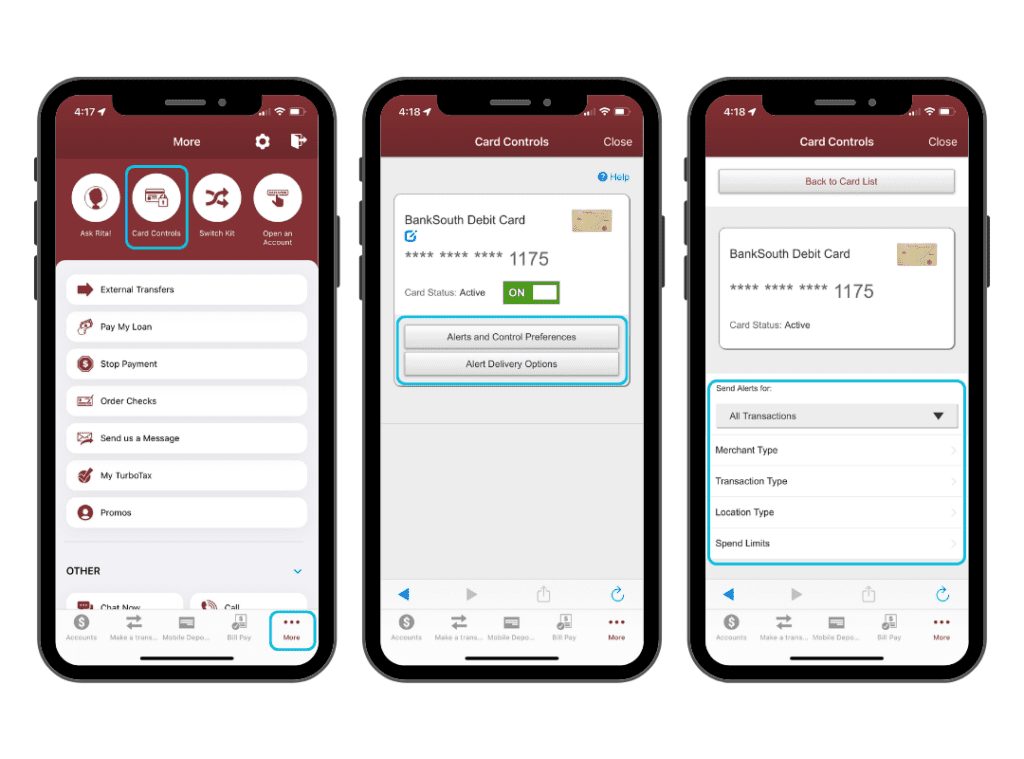

Teaching Kids Financial Responsibility With Card Controls Banksouth Blog Banksouth’s card controls help modernize the way parents teach their children about money management. by providing an interactive and secure platform, children learn to make informed financial decisions while parents guide them on their journey toward fiscal responsibility. Regardless of the age of your kids, learning about financial responsibility is an essential life skill. from learning how to balance a budget to spending responsibly to saving for the future, teaching about money can help set up your kids for financial success.

Teaching Kids Financial Responsibility With Card Controls Banksouth Blog Teaching kids about money early on helps them develop smart financial habits that last a lifetime. when children understand the value of money, they are more likely to make informed spending decisions, avoid debt traps, and grow into financially responsible adults. Financial literacy activities prepare children for the real world, helping them develop essential skills like budgeting, saving, and making informed decisions. i'll explore 20 engaging and age appropriate money lessons that will set your kids on the path to financial success. Dive into effective strategies for teaching kids financial responsibility early, ensuring they grow up with smart healthy money habits. Using the growth spending account to teach your child financial responsibility can set them up for a lifetime of smart money management. by involving them in the process, setting clear rules, and encouraging thoughtful spending, you can help them develop essential financial skills in a supportive and controlled environment.

Tips For Teaching Your Kids Financial Responsibility Dive into effective strategies for teaching kids financial responsibility early, ensuring they grow up with smart healthy money habits. Using the growth spending account to teach your child financial responsibility can set them up for a lifetime of smart money management. by involving them in the process, setting clear rules, and encouraging thoughtful spending, you can help them develop essential financial skills in a supportive and controlled environment. Current is an app based smart debit card for teens. it allows parents like you and i to teach our children financial responsibility and money management. it sounds like a tall order, i know, but it is actually simple. i will break it down for you. here’s how it works: you sign up at current in less than two minutes. (grab the code below!). By equipping your children with financial knowledge, you’re setting them up for a lifetime of financial health and stability. one of the best ways to build a strong financial foundation is to start teaching financial concepts at a young age. here’s how you can introduce age appropriate lessons:. A gohenry prepaid debit card means kids can get to grips with the practicalities of financial basics and financial responsibilities. with a regular allowance they can learn about savings, protecting their money, spending wisely and earning payments, in a safe and easy way. At banksouth, we believe in equipping young people with the tools they need to build a secure financial future. from innovative banking tools to financial education programs that resonate with kids, the article highlights how we’re shaping the next generation’s financial literacy.

Teaching Kids Financial Responsibility Current is an app based smart debit card for teens. it allows parents like you and i to teach our children financial responsibility and money management. it sounds like a tall order, i know, but it is actually simple. i will break it down for you. here’s how it works: you sign up at current in less than two minutes. (grab the code below!). By equipping your children with financial knowledge, you’re setting them up for a lifetime of financial health and stability. one of the best ways to build a strong financial foundation is to start teaching financial concepts at a young age. here’s how you can introduce age appropriate lessons:. A gohenry prepaid debit card means kids can get to grips with the practicalities of financial basics and financial responsibilities. with a regular allowance they can learn about savings, protecting their money, spending wisely and earning payments, in a safe and easy way. At banksouth, we believe in equipping young people with the tools they need to build a secure financial future. from innovative banking tools to financial education programs that resonate with kids, the article highlights how we’re shaping the next generation’s financial literacy.

Teaching Kids Financial Responsibility Momsgetreal A gohenry prepaid debit card means kids can get to grips with the practicalities of financial basics and financial responsibilities. with a regular allowance they can learn about savings, protecting their money, spending wisely and earning payments, in a safe and easy way. At banksouth, we believe in equipping young people with the tools they need to build a secure financial future. from innovative banking tools to financial education programs that resonate with kids, the article highlights how we’re shaping the next generation’s financial literacy.

Tips For Teaching Kids Financial Responsibility Parent Club