Difference Between Family Floater And Individual Policy A family floater health insurance plan covers more than one member of a family. that is, if you buy a floater health insurance plan it will provide cover to you, your spouse, children, and parents – depending on whose name you want to include in the plan. The difference between a multi individual plan and a family floater plan lies in the coverage structure. in a multi individual plan, each individual has their own coverage limit, while a family floater plan provides a shared sum insured for the entire family.

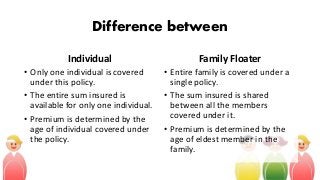

Difference Between Family Floater And Individual Policy In this article, we will discuss the key distinctions between family floater and individual policies, as well as factors to consider when choosing between the two. family floater policies cover the entire family under a single sum insured, whereas individual policies provide coverage to a single person. While family floater and individual health insurance plans aim to provide financial protection against medical expenses, they differ in structure, cost, and flexibility. here’s a side by side breakdown of family floater vs individual health insurance to help understand the key distinctions:. Key differences between individual and family floater health insurance: coverage and flexibility: individual plans offer separate coverage for each member, while family floater plans provide shared coverage, which may limit availability if one member makes a large claim. The individual and family floater health insurance plans affect your savings differently. while an individual health plan requires separate premium payments for each family member insured, the family floater plan requires payment of a single premium.

Difference Between Family Floater And Individual Policy Key differences between individual and family floater health insurance: coverage and flexibility: individual plans offer separate coverage for each member, while family floater plans provide shared coverage, which may limit availability if one member makes a large claim. The individual and family floater health insurance plans affect your savings differently. while an individual health plan requires separate premium payments for each family member insured, the family floater plan requires payment of a single premium. So, understand what individual and family floater policies are all about and know their pros and cons. assess your coverage needs and then choose a suitable policy that provides all inclusive coverage. Both family floater and individual health plans have their benefits and limitations. choosing the right option depends on your family’s health needs, budget, and personal preferences. Choosing between an individual health plan and a family floater depends on factors such as the age of family members, health conditions, and budget. individual plans are better for specific, personalized needs, while family floater plans offer convenience and cost savings for families. Let us learn about the difference between individual health insurance and family health insurance (floater health insurance) and their advantages over individual health insurance plans. what is a family floater health insurance plan?.