Economics Project Role Of Rbi In Control Of Credit Pdf Patel. what is credit control in india? credit control is a role of the reserve bank of india, which regulates credit, or the supply and the demand of money or liquidity in the economy. the central bank controls the credit extended by commercial banks to their customers through this function. credit control is used to control the demand and supply. It introduces rbi and describes some of its key functions including issuing currency, acting as the government's bank, maintaining commercial banks' cash reserves, and controlling credit. the document then covers economic concepts related to rbi's role, including definitions of deflation, inflation, and monetary policies.

Role Of Rbi In Control Of Credit Economics Project Class 12 2019 20 Maintaining price stability and reining in inflation in the economy is one of the rbi’s principal duties. it accomplishes this through controlling interest rates and the flow of credit and money into the economy. Economics project on rbi [reserve bank of india] class12th cbse 2023 24 role of rbi in control of credit please like, comment & subscribe to my channel to s. The reserve bank of india was found on 1 april 1935 to respond to economic troubles after the first world war. the reserve bank of india was conceptualised based on the guidelines presented by the central legislative assembly which passed these guidelines as the rbi act 1934. • rbi regulates commercial banks and non banking finance companies working in india. • it serves as the leader of the banking system and the money market. • it regulates money supply and credit in the country. • the rbi carries out india's monetary policy and exercises supervision and control over banks and non banking finance companies in india.

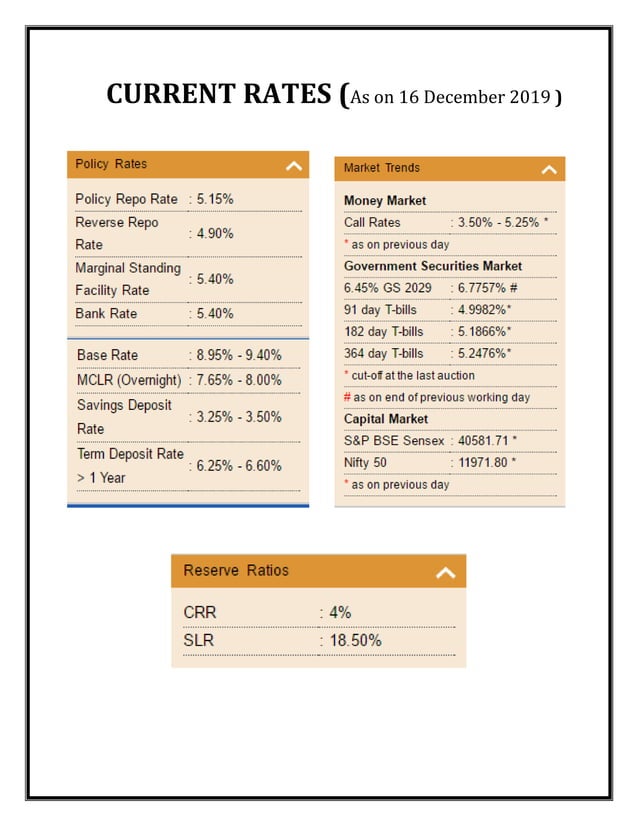

Role Of Rbi In Control Of Credit Economics Project Class 12 2019 20 The reserve bank of india was found on 1 april 1935 to respond to economic troubles after the first world war. the reserve bank of india was conceptualised based on the guidelines presented by the central legislative assembly which passed these guidelines as the rbi act 1934. • rbi regulates commercial banks and non banking finance companies working in india. • it serves as the leader of the banking system and the money market. • it regulates money supply and credit in the country. • the rbi carries out india's monetary policy and exercises supervision and control over banks and non banking finance companies in india. Hskehvebhsvsjjsbeieb role of rbi in control of credit history introduction structure functions demonetisation credit control need limitations current rates. It is the duty of the rbi to control the credit through the crr, bank rate and open market operations. as banker's bank, the rbi facilitates the clearing of cheques between the commercial banks and helps the inter bank transfer of funds. It is one of the important function of rbi for controlling supply of money or credit. there are 2 types of methods employed by the rbi to control credit creation:.

Role Of Rbi In Control Of Credit Class 12 Economics Hskehvebhsvsjjsbeieb role of rbi in control of credit history introduction structure functions demonetisation credit control need limitations current rates. It is the duty of the rbi to control the credit through the crr, bank rate and open market operations. as banker's bank, the rbi facilitates the clearing of cheques between the commercial banks and helps the inter bank transfer of funds. It is one of the important function of rbi for controlling supply of money or credit. there are 2 types of methods employed by the rbi to control credit creation:.

Role Of Rbi In Control Of Credit Class 12 Economics Pdf It is one of the important function of rbi for controlling supply of money or credit. there are 2 types of methods employed by the rbi to control credit creation:.

Role Of Rbi In Control Of Credit Economics Project Class 12 2019 20