Enterprise Value Ev Formula And What It Means Pdf Valuation The calculation of enterprise value equation can be done in the following six simple steps: firstly, the current price per share of the company has to be found out from the stock market, and then the number of paid up equity shares has to be collected from the balance sheet. Ev is more comprehensive than market capitalization (market cap), which includes only equity. the formula below is used to calculate ev: ev = market capitalization total debt cash. in this formula, market capitalization is equal to the market value of equity shares (otherwise called the common equity). the expanded version of this formula is:.

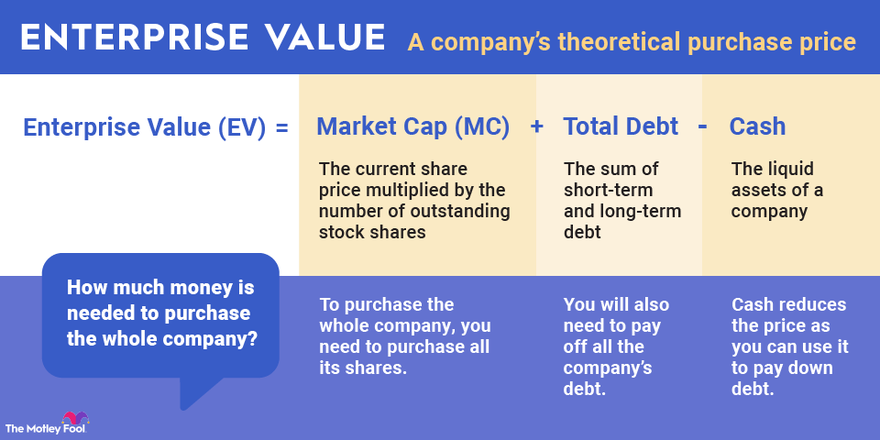

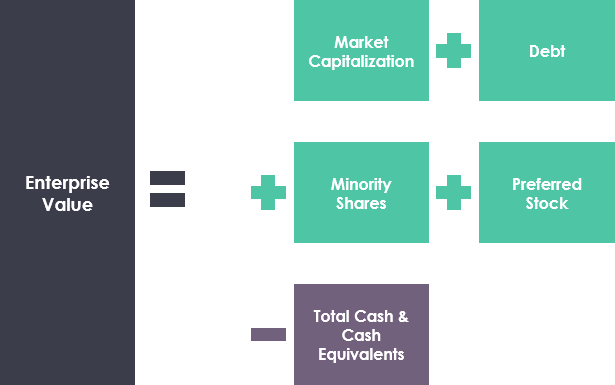

Enterprise Value Formula And Calculation Financial Falconet Follow this guide to ensure that enterprise value is complete and consistent with the profit and cash flow metrics used in dcf and to produce ev multiples. to read more about common mistakes in calculating ev see our article enterprise value – calculation and mis calculation. Learn how to calculate enterprise value using a simple, step by step method designed for private business owners. this guide explains discounted cash flow, terminal value, and how to use these tools to understand what your business is really worth. Use the calculator below to instantly estimate enterprise value based on market cap, debt, and cash. the basic formula for enterprise value is: where: let’s say a company has: that’s the true cost to acquire the business. The simple formula for enterprise value is: ev = market capitalization market value of debt – cash and equivalents. the extended formula is: ev = common shares preferred shares market value of debt noncontrolling interest – cash and equivalents. what are the components of ev?.

Enterprise Value Ev Formula And What It Means 54 Off Use the calculator below to instantly estimate enterprise value based on market cap, debt, and cash. the basic formula for enterprise value is: where: let’s say a company has: that’s the true cost to acquire the business. The simple formula for enterprise value is: ev = market capitalization market value of debt – cash and equivalents. the extended formula is: ev = common shares preferred shares market value of debt noncontrolling interest – cash and equivalents. what are the components of ev?. Enterprise value (ev) is a financial metric that provides a comprehensive view of a company’s overall value, considering its debt and equity. ev is calculated by adding a company’s market capitalization to its total debt and subtracting any cash or cash equivalents it holds. Formula: ev = market cap total debt total cash. for companies with lots of debt or lots of cash, enterprise value is a much more useful way to measure the "true price" of a company or stock. if you buy a company, then you also receive the company's cash and debt. Enterprise value is relatively easy to calculate if you know where to find the variables. the formula for calculating ev is as follows: enterprise value (ev) = market capitalization. How to calculate enterprise value the enterprise value formula is straightforward: ev = market capitalization total debt – cash and cash equivalents to calculate ev, start by finding the company’s market capitalization, which is the share price multiplied by the number of outstanding shares.

Enterprise Value Ev Formula And What It Means 54 Off Enterprise value (ev) is a financial metric that provides a comprehensive view of a company’s overall value, considering its debt and equity. ev is calculated by adding a company’s market capitalization to its total debt and subtracting any cash or cash equivalents it holds. Formula: ev = market cap total debt total cash. for companies with lots of debt or lots of cash, enterprise value is a much more useful way to measure the "true price" of a company or stock. if you buy a company, then you also receive the company's cash and debt. Enterprise value is relatively easy to calculate if you know where to find the variables. the formula for calculating ev is as follows: enterprise value (ev) = market capitalization. How to calculate enterprise value the enterprise value formula is straightforward: ev = market capitalization total debt – cash and cash equivalents to calculate ev, start by finding the company’s market capitalization, which is the share price multiplied by the number of outstanding shares.