Irs Tax Transcript Online Request Get Transcript By Mail Pdf You can access your personal tax records online or by mail, including transcripts of past tax returns, tax account information, wage and income statements, and verification of non filing letters. if you need a transcript for your business, find out how to get a business tax transcript. The tax account transcript is available for the current and nine prior tax years through get transcript online and the current and three prior tax years through get transcript by mail or by calling 800 908 9946.

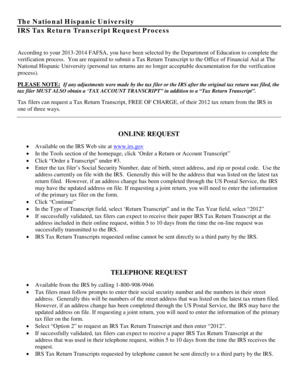

Fillable Online Nhu 2013 2014 Irs Tax Return Transcript Request Process Your best bet is to switch to an alternative method: request your transcript by mail using form 4506 t or 4506t ez, or by phone at 800 908 9946 (for tax return or tax account transcripts only). You can get tax information via an irs transcript. see the irs tax transcript choices, how to request a transcript online and how to get copies of tax returns. Accessing your irs tax transcript online is a straightforward process. follow these simple steps to retrieve your transcript: select “get your tax record”: under the “tools” section, select “get your tax record.” alternatively, you can directly visit the transcript page by clicking here. Use form 4506 t to request any of the transcripts: tax return, tax account, wage and income, record of account and verification of non filling. the transcript format better protects taxpayer data by partially masking personally identifiable information.

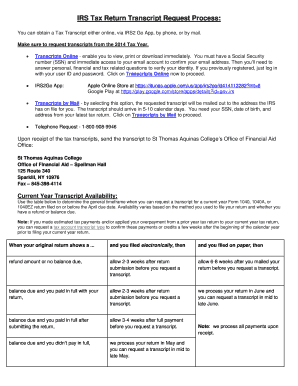

Fillable Online Gccnj Telef Irs Tax Return Transcript Request Process Accessing your irs tax transcript online is a straightforward process. follow these simple steps to retrieve your transcript: select “get your tax record”: under the “tools” section, select “get your tax record.” alternatively, you can directly visit the transcript page by clicking here. Use form 4506 t to request any of the transcripts: tax return, tax account, wage and income, record of account and verification of non filling. the transcript format better protects taxpayer data by partially masking personally identifiable information. To get a transcript online, you would need to create an online account with the irs, if you don't already have one. "the fastest and easiest way taxpayers can get last year’s information for. Complete irs form 4506 t, request for transcript of tax return, and mail it to the appropriate irs address listed on the form, which varies by state. the form requires details such as your name, social security number, and the specific years for which transcripts are needed. By mail: use form 4506 t (request for transcript of tax return) or form 4506 t ez. submit the completed form to the irs via mail or fax. transcripts typically arrive within 5 10 business days. by phone: call the irs at 1 800 908 9946 to request a transcript. be prepared to provide your social security number, date of birth, and address. You can request a transcript electronically through the irs website, by calling the irs at 1 800 908 9946, or by mailing a completed form 4506 t to the irs address listed on the form.

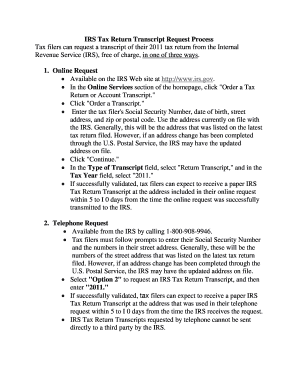

Fillable Online Irs Tax Return Transcript Request Process Fax Email To get a transcript online, you would need to create an online account with the irs, if you don't already have one. "the fastest and easiest way taxpayers can get last year’s information for. Complete irs form 4506 t, request for transcript of tax return, and mail it to the appropriate irs address listed on the form, which varies by state. the form requires details such as your name, social security number, and the specific years for which transcripts are needed. By mail: use form 4506 t (request for transcript of tax return) or form 4506 t ez. submit the completed form to the irs via mail or fax. transcripts typically arrive within 5 10 business days. by phone: call the irs at 1 800 908 9946 to request a transcript. be prepared to provide your social security number, date of birth, and address. You can request a transcript electronically through the irs website, by calling the irs at 1 800 908 9946, or by mailing a completed form 4506 t to the irs address listed on the form.

Fillable Online Irs Tax Return Transcript Request Process 1 Odu Fax By mail: use form 4506 t (request for transcript of tax return) or form 4506 t ez. submit the completed form to the irs via mail or fax. transcripts typically arrive within 5 10 business days. by phone: call the irs at 1 800 908 9946 to request a transcript. be prepared to provide your social security number, date of birth, and address. You can request a transcript electronically through the irs website, by calling the irs at 1 800 908 9946, or by mailing a completed form 4506 t to the irs address listed on the form.