Growth Vs Value Traders On Which To Back In The Second Quarter Value vs. growth performance as the technology sector soared, growth stocks regained the lead over value stocks in the second quarter after lagging during the first three months of the year. The s&p 500 value etf has outperformed growth by a margin of 2% over the quarter, which could mean the tide is shifting in favor of value in recent terms and potentially out of growth, which was once the winner for the year so far.

Growth Vs Value Two Traders Place Their Bets Trading Analysis As investors weigh the pros and cons of value vs. growth stocks, cnbc pro asked analysts and investors which they prefer. Here’s what some top investing pros say about growth and value investing, and when we might see value investing begin to outperform again. differences between growth investing and value investing. Value investors buy companies, while growth investors buy stocks. our data analysis for the past decade shows that growth stocks have outperformed value stocks. growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%. let’s take a look at the data!. The growth to value rotation: in recent years, there have been shifts in leadership between growth and value stocks. for example, after a decade of growth stock outperformance following the 2008 financial crisis, value stocks began to regain favor during the economic uncertainty of 2020 and 2021, driven by sectors like financials and energy.

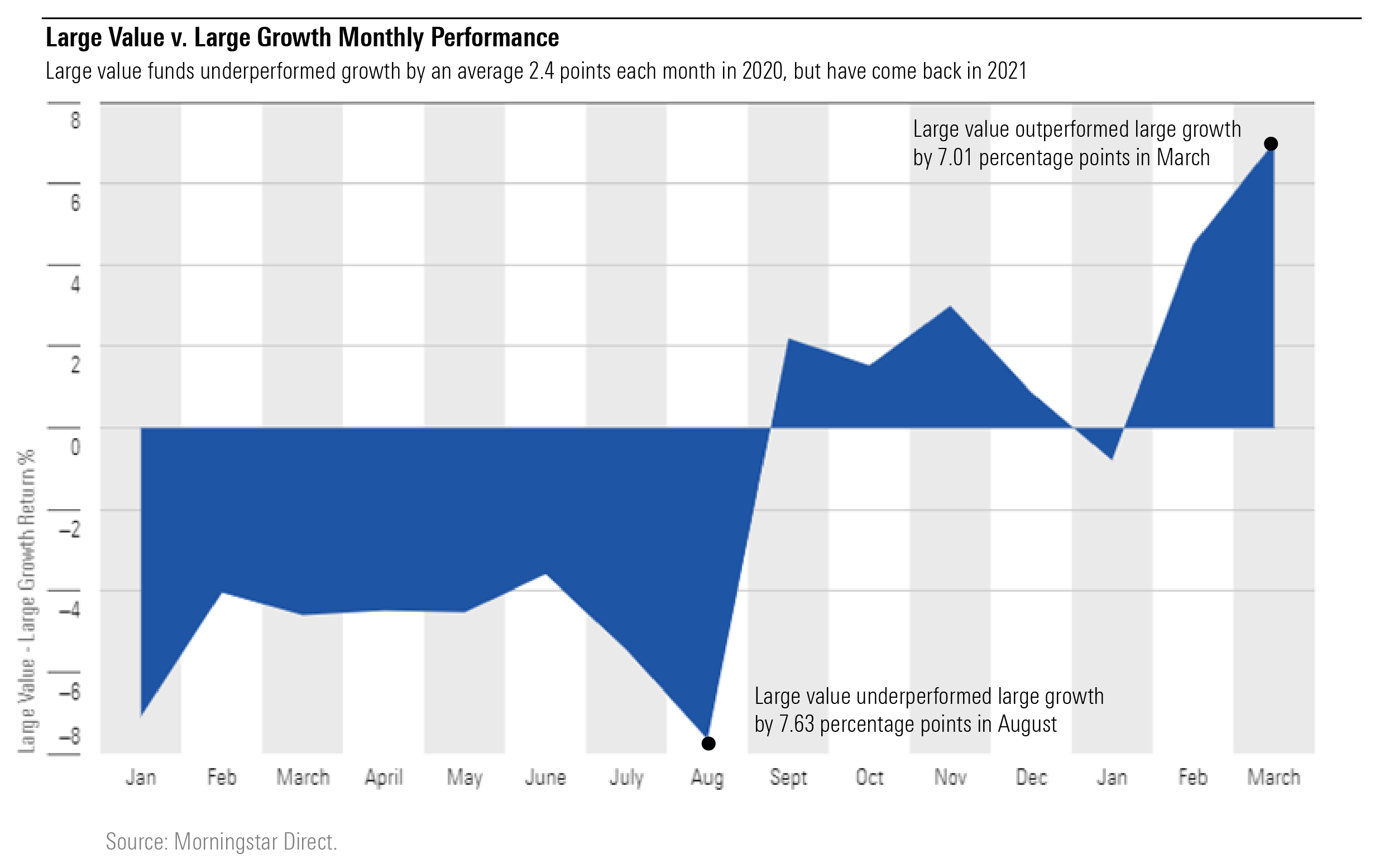

Value Funds Post Best Quarter Vs Growth In 20 Years Morningstar Value investors buy companies, while growth investors buy stocks. our data analysis for the past decade shows that growth stocks have outperformed value stocks. growth investing has shown a remarkable return rate of 523%, while value investing has yielded 247%. let’s take a look at the data!. The growth to value rotation: in recent years, there have been shifts in leadership between growth and value stocks. for example, after a decade of growth stock outperformance following the 2008 financial crisis, value stocks began to regain favor during the economic uncertainty of 2020 and 2021, driven by sectors like financials and energy. Growth to value: which rotation is next? the magnificent seven and many other large cap growth stocks were among the winners in 2024. however, in 2025, investors are shunning the largest market. Both growth and value stocks can bring returns to investors. the difference lies mainly in the way in which they are perceived by the market and, ultimately, the investors. and. After narrowly beating out growth stocks in the first quarter, value stocks lagged in the second. the us value index fell 1.47%, compared with a 2.42% gain for the us growth index. reflecting the. If it trades lower, into the consolidation, that may signal growth stocks are back in favor, but if it turns higher, value should find support. this is significant because growth stocks.

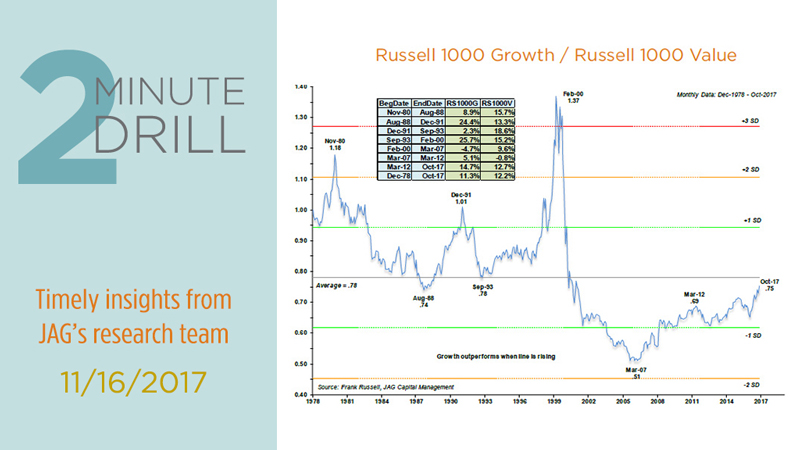

Growth Vs Value Market Insights Jag Capital Management Growth to value: which rotation is next? the magnificent seven and many other large cap growth stocks were among the winners in 2024. however, in 2025, investors are shunning the largest market. Both growth and value stocks can bring returns to investors. the difference lies mainly in the way in which they are perceived by the market and, ultimately, the investors. and. After narrowly beating out growth stocks in the first quarter, value stocks lagged in the second. the us value index fell 1.47%, compared with a 2.42% gain for the us growth index. reflecting the. If it trades lower, into the consolidation, that may signal growth stocks are back in favor, but if it turns higher, value should find support. this is significant because growth stocks.