Using Technical Indicators Trading with technical indicators | james boyd | 1 6 25characteristics and risks of standardized options. bit.ly 2v9th6din our session we show multip. How do indicators relate to price? in our session we show multiple indicators and see how different it was with just looking at the trend, momentum, support & resistance.

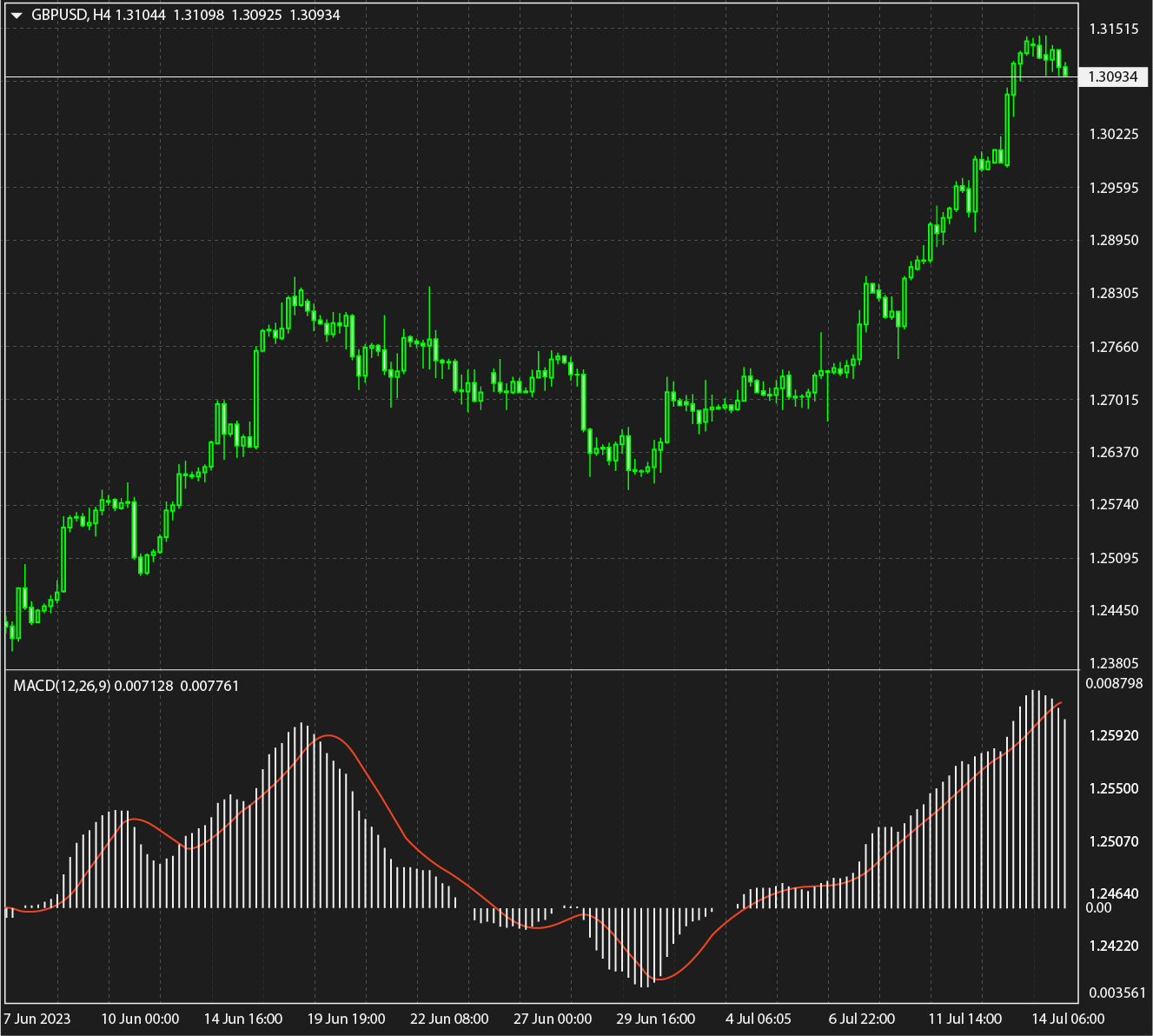

What Is A Trading Indicators And How To Use Them Wisely Technical indicators transform raw market data like price and volume into clear visual signals traders can use to make decisions. they act as filters that help separate meaningful market moves. Technical indicators are math calculations on certain parts of a stock’s performance. they can be simple, like the simple moving average (sma) indicator. this indicator takes a stock’s price over several periods and divides it. it gives you a smoothed down version of a price chart, showing cleaner price trends. Technical indicators act like gauges that enhance your ability to interpret and analyze price action. they visualize patterns and help quantify signals and triggers that can be used to execute trades. here’s four key reasons to use technical indicators: technical indicators help to plot trends and monitor momentum. Technical indicators are mathematical patterns derived from historical data that technical traders and investors use to forecast future price trends and make trading decisions. they derive data points from past price, volume, and open interest data using a mathematical formula.

What Are Technical Indicators Msg Trader Technical indicators act like gauges that enhance your ability to interpret and analyze price action. they visualize patterns and help quantify signals and triggers that can be used to execute trades. here’s four key reasons to use technical indicators: technical indicators help to plot trends and monitor momentum. Technical indicators are mathematical patterns derived from historical data that technical traders and investors use to forecast future price trends and make trading decisions. they derive data points from past price, volume, and open interest data using a mathematical formula. Discover essential technical indicators for successful trading! learn how moving averages, macd, rsi, and other key tools can help you identify market trends, spot entry points, and manage risk. perfect for beginners looking to enhance their trading strategy with data driven insights. Technical indicators are valuable tools that help traders analyze market data and patterns, providing insights into potential future price movements. these indicators are visual representations of mathematical calculations applied to historical price and volume data. Technical indicators are mathematical calculations based on historical price and volume data. these indicators help traders spot patterns, trends, and possible reversal points, providing a clearer understanding of an asset’s price movement. In general, technical indicators are derived from mathematical equations of price action – this means it is driven purely by data. indicators are useful in many ways such as identifying the market condition and finding areas to enter or exit a trade.