Best Technical Indicators For Stock Trading Marketbulls By understanding the different types of technical indicators and their purposes, you can zero in on a few indicators to help you make trading decisions or even build a consistent, rules based trading system. Traders can choose from hundreds of technical indicators, from simple moving averages to complex oscillators. each serves a specific purpose. some measure momentum, others track.

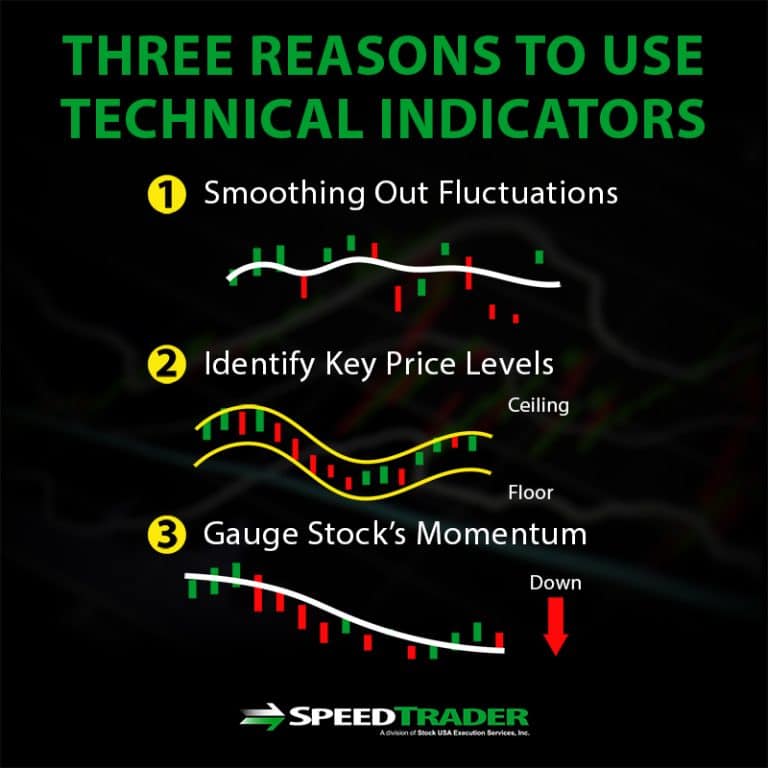

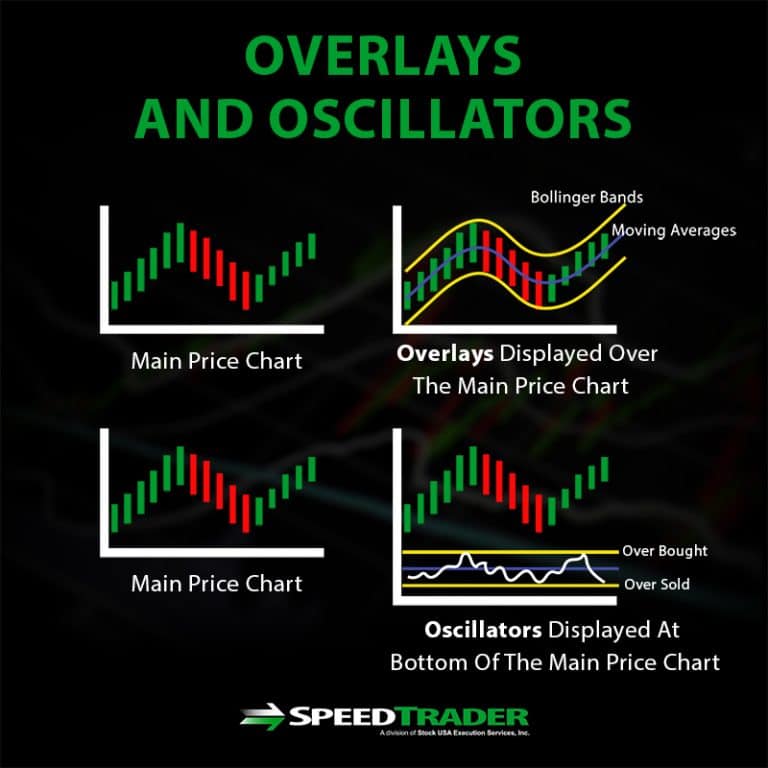

7 Technical Indicators For Stock Trading Upvey Technical indicators are a trading aid that can help give traders a pulse on the market, by measuring volume, price, volatility and more. the moving average can help inform investors of stock trends and any changes in the trend. Stock technical indicators are often rendered as a pattern that can overlay a stock’s price chart to predict the market trend, and whether the stock would be considered “overbought” or “oversold.” stock technical indicators generally come in two flavors: overlay indicators and oscillators. Technical indicators are powerful tools that complement trendlines and chart patterns in technical analysis. they provide traders with a comprehensive view of price movements and potential trading opportunities in financial markets. Technical analysis is an important concept in trading and investing. it involves looking at charts and assessing the next move. in most cases, traders use technical indicators like the moving average, relative strength index, macd, and the stochastic oscillator.

Technical Indicators For Stock Traders Comprehensive Guide Technical indicators are powerful tools that complement trendlines and chart patterns in technical analysis. they provide traders with a comprehensive view of price movements and potential trading opportunities in financial markets. Technical analysis is an important concept in trading and investing. it involves looking at charts and assessing the next move. in most cases, traders use technical indicators like the moving average, relative strength index, macd, and the stochastic oscillator. To optimize your technical analysis strategy, the selection of indicator combinations should be tailored to specific market conditions and aligned with your trading objectives. consider using a mix of trend following, momentum, and volatility indicators to gain comprehensive insights. Cycle volumes, momentum readings, volume patterns, price trends, bollinger bands, moving averages, elliot waves, oscillators, and sentiment indicators are technical indicators used in technical analysis to forecast future price movements. Analyzing market trends through analysis and stock market software is essential for traders and investors to understand price changes and identify potential trading chances effectively using technical indicators to gauge market sentiment and volatility. Technical indicators are powerful tools that can help investors make informed trading decisions. by understanding and applying these indicators, investors can better navigate stock market movements and identify potential opportunities.

Technical Indicators For Stock Traders Comprehensive Guide To optimize your technical analysis strategy, the selection of indicator combinations should be tailored to specific market conditions and aligned with your trading objectives. consider using a mix of trend following, momentum, and volatility indicators to gain comprehensive insights. Cycle volumes, momentum readings, volume patterns, price trends, bollinger bands, moving averages, elliot waves, oscillators, and sentiment indicators are technical indicators used in technical analysis to forecast future price movements. Analyzing market trends through analysis and stock market software is essential for traders and investors to understand price changes and identify potential trading chances effectively using technical indicators to gauge market sentiment and volatility. Technical indicators are powerful tools that can help investors make informed trading decisions. by understanding and applying these indicators, investors can better navigate stock market movements and identify potential opportunities.

Technical Indicators For Stock Traders Comprehensive Guide Analyzing market trends through analysis and stock market software is essential for traders and investors to understand price changes and identify potential trading chances effectively using technical indicators to gauge market sentiment and volatility. Technical indicators are powerful tools that can help investors make informed trading decisions. by understanding and applying these indicators, investors can better navigate stock market movements and identify potential opportunities.