Gstr 1 Report To File Gst Return Using Tally Erp9 Explained about how to create generate goods and service tax invoice in tally erp9 and gst sales entry more. Learn about gst billing in tally and how to create a gst invoice in tally. also, learn how you can do tally invoice printing customization to differentiate your business.

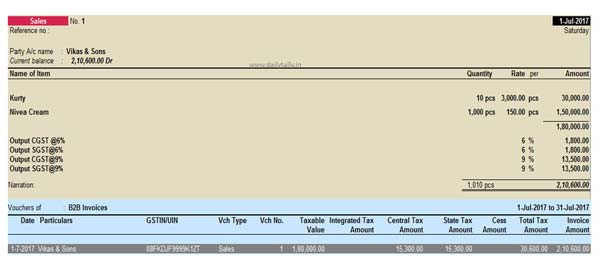

How To File Gstr 1 From Tally Erp 9 Release 6 Learn how to create gst invoice in tally. additionaly, learn how to print sales invoice with authorized signature and more. read this article!. Gstr 1 has to be filed by a taxable person registered under gst. gstr 1 returns can be generated from tally.erp 9 in the json format , and uploaded to the portal for filing returns. you need to file gstr 1 returns: this section provides a summary of all transactions recorded in the reporting period. you can drill down on each row to view the. Igst [ integrated tax for both purchase and sale outside state] to create ‘sgst’ ledger: 1. go to gateway of tally > accounts info. > ledgers > create. 2. in under, select duties & taxes. 3. select gst as the type of duty tax. 4. select state tax as the tax type. note : percentage of calculation should be 0% ( don’t change ) due to. In this guide, we’ll walk you through step by step gst entries in tally, including setting up gst, creating invoices, and filing returns. before recording gst transactions, you must activate gst features in tally. how to enable gst in tally? open tally erp 9 or tally prime. go to gateway of tally > f11: features > statutory & taxation.

How To Create Tax Invoice In Tally Erp 9 Energyper Igst [ integrated tax for both purchase and sale outside state] to create ‘sgst’ ledger: 1. go to gateway of tally > accounts info. > ledgers > create. 2. in under, select duties & taxes. 3. select gst as the type of duty tax. 4. select state tax as the tax type. note : percentage of calculation should be 0% ( don’t change ) due to. In this guide, we’ll walk you through step by step gst entries in tally, including setting up gst, creating invoices, and filing returns. before recording gst transactions, you must activate gst features in tally. how to enable gst in tally? open tally erp 9 or tally prime. go to gateway of tally > f11: features > statutory & taxation. 📄 create gst invoice in tally erp 9 | step by step tutorial (2025 updated) in this video, you will learn how to create a gst invoice in tally erp 9 quickly and. In this article, we will explain to you how to record purchase invoice in tally erp 9. release 6 for gst. purchases can be of two types : local purchases on which cgst and sgst are applicable. interstate purchase on which igst is applicable. before making purchase entry in tally, you need to create ledgers relates to purchases. Learn how to generate a gst sales invoice in tally erp 9. follow simple steps to create and print gst compliant sales invoices easily. Learn what is goods and services tax and what are the types of taxes under gst and how to start using this in tally erp 9. read on!.

Dynamic Gst Invoice For Tally Erp 9 Tally Data Connector 📄 create gst invoice in tally erp 9 | step by step tutorial (2025 updated) in this video, you will learn how to create a gst invoice in tally erp 9 quickly and. In this article, we will explain to you how to record purchase invoice in tally erp 9. release 6 for gst. purchases can be of two types : local purchases on which cgst and sgst are applicable. interstate purchase on which igst is applicable. before making purchase entry in tally, you need to create ledgers relates to purchases. Learn how to generate a gst sales invoice in tally erp 9. follow simple steps to create and print gst compliant sales invoices easily. Learn what is goods and services tax and what are the types of taxes under gst and how to start using this in tally erp 9. read on!.