How To Create Gst Tax Service Invoice In Tally Tally Knowledge How to create gst service invoice in tallyerp.9 tally knowledge 2.63k subscribers subscribed 128. Learn how to create gst invoice in tally. additionaly, learn how to print sales invoice with authorized signature and more. read this article!.

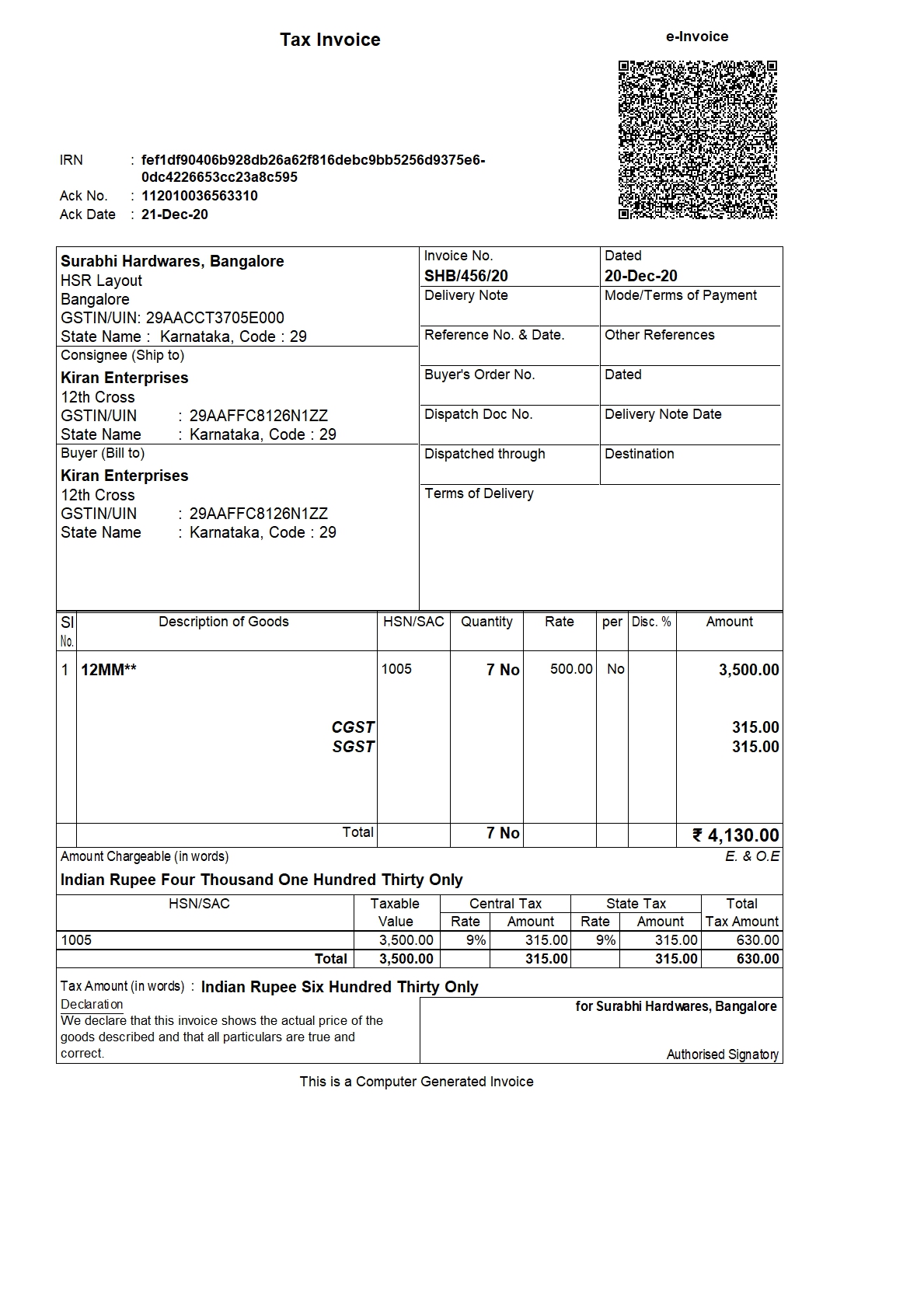

How To Create Gst Tax Service Invoice In Tally Tally Knowledge How to create a tally gst invoice format in excel with easy steps how to create gst invoice in tally. based on gst invoicing rules (rule 5), 2016 issued by the central government, two kinds of invoices can be issued under gst namely tax invoice & bill of supply. Learn about gst billing in tally and how to create a gst invoice in tally. also, learn how you can do tally invoice printing customization to differentiate your business. Generating a gst invoice in tallyprime is straightforward if you follow these steps: 1. open tallyprime: start by launching the tallyprime software on your computer. 2. go to ‘gateway of tally’: select ‘vouchers’ from the main menu. 3. access ‘sales voucher’: navigate to ‘create’ under ‘vouchers’ and choose ‘sales’. 4. In this guide, we’ll walk you through step by step gst entries in tally, including setting up gst, creating invoices, and filing returns. before recording gst transactions, you must activate gst features in tally. how to enable gst in tally? open tally erp 9 or tally prime. go to gateway of tally > f11: features > statutory & taxation.

How To Create Composition Gst Invoice In Tally Erp9 Tally Knowledge Generating a gst invoice in tallyprime is straightforward if you follow these steps: 1. open tallyprime: start by launching the tallyprime software on your computer. 2. go to ‘gateway of tally’: select ‘vouchers’ from the main menu. 3. access ‘sales voucher’: navigate to ‘create’ under ‘vouchers’ and choose ‘sales’. 4. In this guide, we’ll walk you through step by step gst entries in tally, including setting up gst, creating invoices, and filing returns. before recording gst transactions, you must activate gst features in tally. how to enable gst in tally? open tally erp 9 or tally prime. go to gateway of tally > f11: features > statutory & taxation. How to create gst service invoice in tallyerp9 | learn gst step by step: part 6 | tally online class#b2b #tallyerp9 #tallyonlineclasstally online class prese. In this guide, we’ll walk you through the updated process of creating invoices in tally prime (2025), incorporating the latest gst rules, customization tips, and automation tools. To create a sales invoice with gst in tally erp 9, navigate to the ‘sales’ menu, select ‘create invoice,’ and fill in the required details. ensure accuracy and completeness of information to maintain proper accounting records and comply with tax regulations. After generating the gst invoice, you can go to the sales register or ledger report to review and reconcile all gst transactions. tallyprime ensures that the correct gst filing format (gstr 1, gstr 3b) is followed and facilitates seamless gst return filing.

Gst Filing Being Possible With The Help Of Tally Gst Software Tally How to create gst service invoice in tallyerp9 | learn gst step by step: part 6 | tally online class#b2b #tallyerp9 #tallyonlineclasstally online class prese. In this guide, we’ll walk you through the updated process of creating invoices in tally prime (2025), incorporating the latest gst rules, customization tips, and automation tools. To create a sales invoice with gst in tally erp 9, navigate to the ‘sales’ menu, select ‘create invoice,’ and fill in the required details. ensure accuracy and completeness of information to maintain proper accounting records and comply with tax regulations. After generating the gst invoice, you can go to the sales register or ledger report to review and reconcile all gst transactions. tallyprime ensures that the correct gst filing format (gstr 1, gstr 3b) is followed and facilitates seamless gst return filing.

Lesson 36 How To Create Pos Invoice Tally Knowledge Vrogue Co To create a sales invoice with gst in tally erp 9, navigate to the ‘sales’ menu, select ‘create invoice,’ and fill in the required details. ensure accuracy and completeness of information to maintain proper accounting records and comply with tax regulations. After generating the gst invoice, you can go to the sales register or ledger report to review and reconcile all gst transactions. tallyprime ensures that the correct gst filing format (gstr 1, gstr 3b) is followed and facilitates seamless gst return filing.