Tally Erp 9 Practise Set 1 Pdf Value Added Tax Invoice Here you can request for the tdl file for inclusive & exclusive tax for tally.erp 9 software. Introduction with the help of this add on user can “tax inclusive price level” standing y important! take back up of your company data before activating the add on. once you try purchase an add on, follow the steps below to configure the add on and use it.

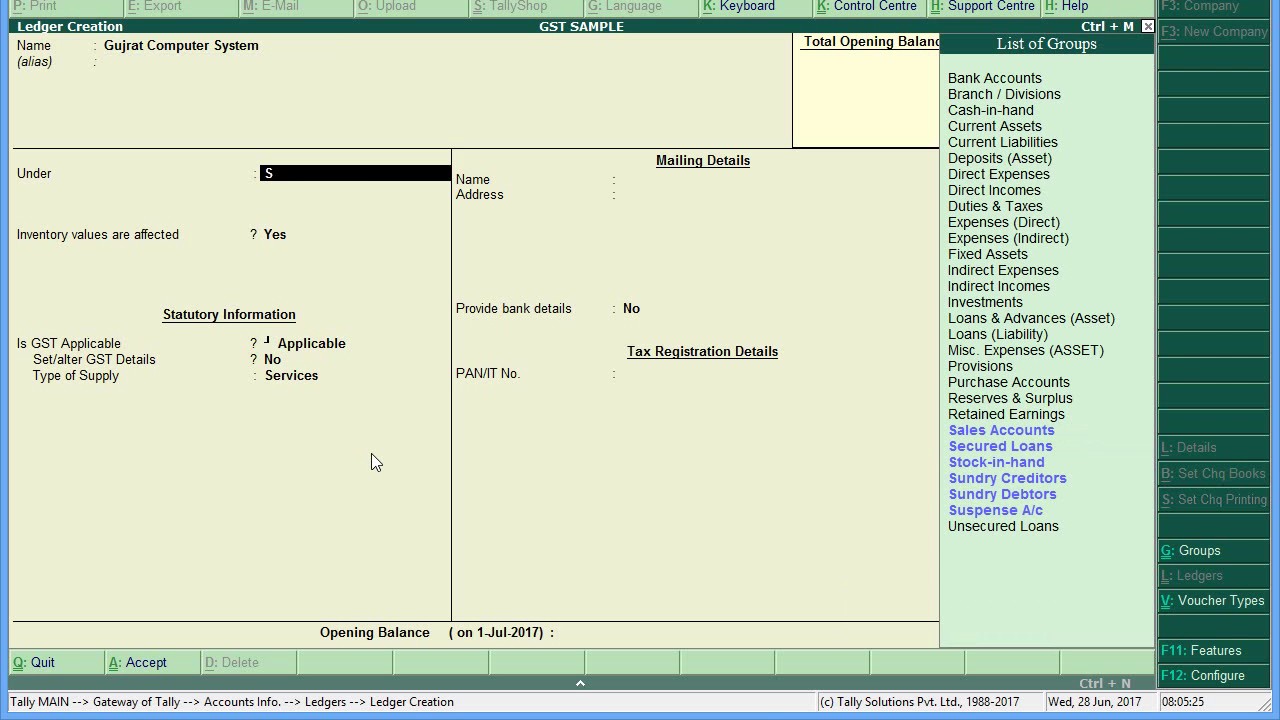

Inclusive Exclusive Tax For Tax Invoice For Tally Erp 9 Tally Data Inclusive & exclusive tax tdl for tax invoice in tally erp 9 here is the preview of this tdl file how to install the tdl file in tally step 1. go to gateway of tally. step 2. then press ctrl alt t button step 3. now press f4 button or click on “manage local tdl” button step 4. now do “yes” to “loan tdl files on startup” option step 5. Assign inclusive tax rate of the item in incl. of tax rate column, tallyprime will automatically calculate the items value after deducting gst as per given sale invoice with example. When defining the price of the item you can include the tax rate. 1. go to gateway of tally > inventory info. > stock items > create alter > f12: configure . 2. set allow inclusive of tax for stock items to yes . 3. press ctrl a to go to the stock item alteration screen. 4. set is inclusive of duties and taxes? to yes . 5. Assign inclusive tax rate of the item in incl. of tax rate column, tallyprime will automatically calculate the items value after deducting gst as per given sale invoice with example.

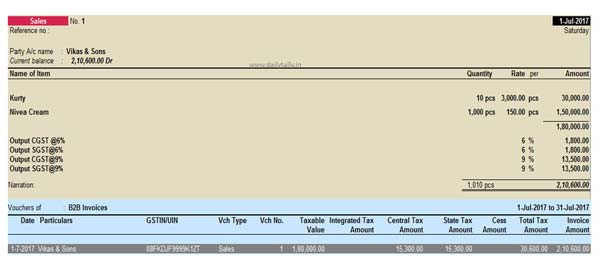

How To Create Tax Invoice In Tally Erp 9 Energyper When defining the price of the item you can include the tax rate. 1. go to gateway of tally > inventory info. > stock items > create alter > f12: configure . 2. set allow inclusive of tax for stock items to yes . 3. press ctrl a to go to the stock item alteration screen. 4. set is inclusive of duties and taxes? to yes . 5. Assign inclusive tax rate of the item in incl. of tax rate column, tallyprime will automatically calculate the items value after deducting gst as per given sale invoice with example. Tdl files for tally.erp 9 invoice printing import export data auto entry screen enhancement. Step 3: now pass the sale entry from gateway of tally > voucher > f8 for sale entry and then press alt p and choose current option and click on preview and you can see the inclusive of tax column on your invoice. note: please ensure that you enable the inclusive of tax option from the f12 menu. "this features allows a user to enter tax inclusive rates while creation invoice. the module will automatically do the reverse calculation based on the defined tax rates on item master.". Enable rate inclusive of tax: press f12 to enable the option "provide rate inclusive of tax for stock item". review and confirm: ensure that the total rate amount matches the calculated value of 220000 (20 units * 11000 rate per unit). then, save the sales voucher. save and confirm: after entering all the details accurately, save the sales voucher.

82 Pdf Tally Erp 9 Invoice Format Download Free Printable Download Tdl files for tally.erp 9 invoice printing import export data auto entry screen enhancement. Step 3: now pass the sale entry from gateway of tally > voucher > f8 for sale entry and then press alt p and choose current option and click on preview and you can see the inclusive of tax column on your invoice. note: please ensure that you enable the inclusive of tax option from the f12 menu. "this features allows a user to enter tax inclusive rates while creation invoice. the module will automatically do the reverse calculation based on the defined tax rates on item master.". Enable rate inclusive of tax: press f12 to enable the option "provide rate inclusive of tax for stock item". review and confirm: ensure that the total rate amount matches the calculated value of 220000 (20 units * 11000 rate per unit). then, save the sales voucher. save and confirm: after entering all the details accurately, save the sales voucher.

18 Pdf Tally Erp 9 Invoice Format Free Printable Download Docx Zip "this features allows a user to enter tax inclusive rates while creation invoice. the module will automatically do the reverse calculation based on the defined tax rates on item master.". Enable rate inclusive of tax: press f12 to enable the option "provide rate inclusive of tax for stock item". review and confirm: ensure that the total rate amount matches the calculated value of 220000 (20 units * 11000 rate per unit). then, save the sales voucher. save and confirm: after entering all the details accurately, save the sales voucher.