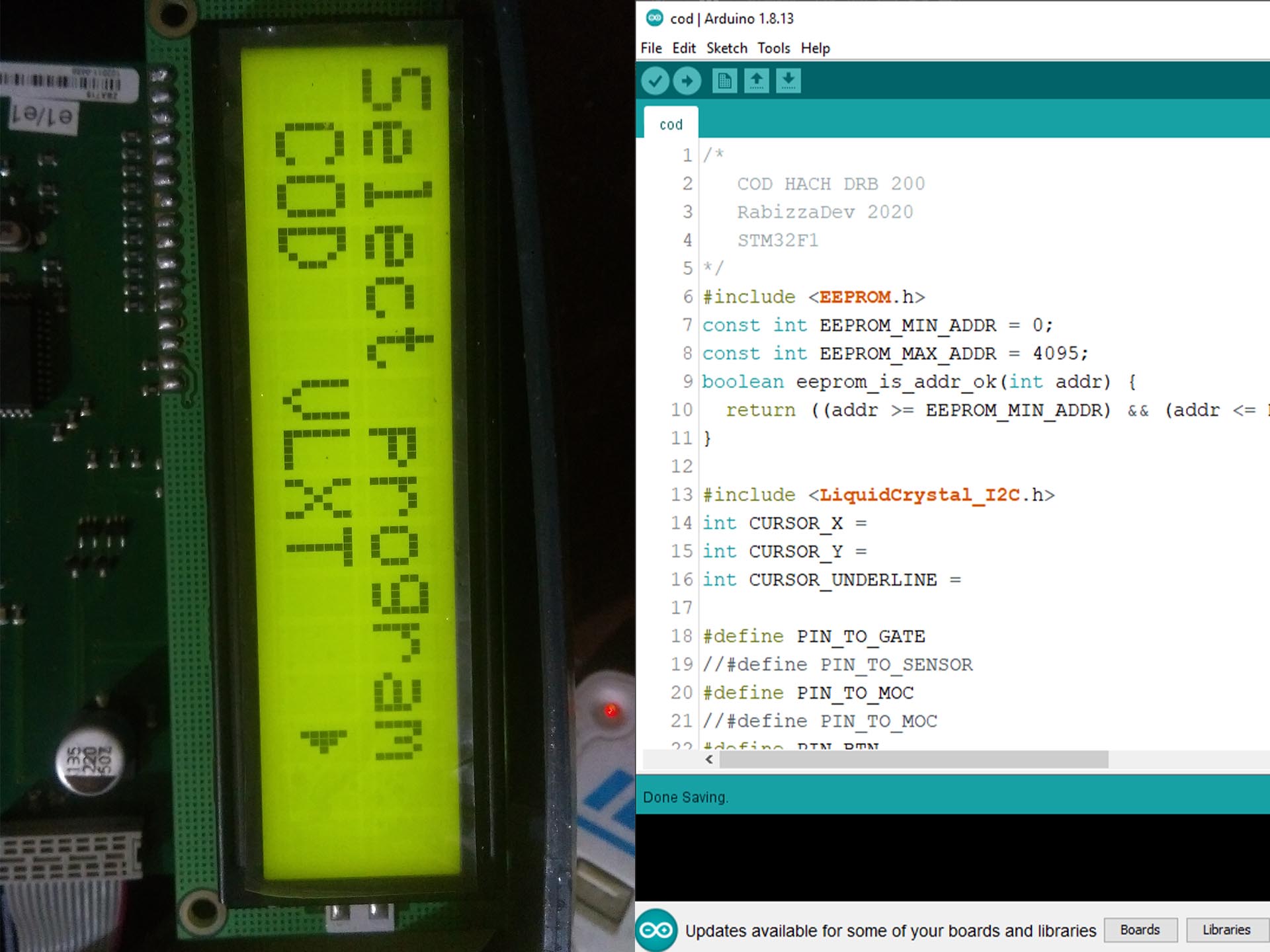

Jasa Pembuatan Project Arduino Top withholding agents (twas) are required to deduct and remit either 1% or 2% creditable withholding tax from the income payments to their suppliers of goods and services, respectively. Withholding tax on government money payments to suppliers – 1% on goods, 2% on services (sec. 2.57.2 (j), rr 2 98) this applies to payments of government offices, agencies, instrumentalities, and goccs on purchases from local resident suppliers of goods at 1%, or of services at 2% of such gross payments.

Butuh Jasa Program Arduino Project Elangsakti The introduction of the “1% withholding tax” on online sellers in the philippines marks a significant step towards modernizing the tax system and adapting it to the realities of a booming digital economy. One percent (1%) expanded withholding tax. what is the tax base? one half (1 2) of the gross remittances by electronic marketplace operators and digital financial services providers to the sellers for the goods or services sold and paid through their platform or facility. The bureau of internal revenue (bir) announced that online merchants sellers with earnings amounting to more than p500,000 annually are now subject to a 1% withholding tax. Credit withholding tax (cwt) of 1% on one half of the gross remittances made by e marketplace operators and dfsps to sellers merchants for goods and services paid through the platform facility. (ex: p5 for p1,000 to be remitted).

Jual Jual Jasa Pembuatan Program Arduino Esp32 Dan Esp8266 Shopee The bureau of internal revenue (bir) announced that online merchants sellers with earnings amounting to more than p500,000 annually are now subject to a 1% withholding tax. Credit withholding tax (cwt) of 1% on one half of the gross remittances made by e marketplace operators and dfsps to sellers merchants for goods and services paid through the platform facility. (ex: p5 for p1,000 to be remitted). Manila – the bureau of internal revenue (bir) has announced that online merchants with earnings amounting to more than php500,000 annually are now subject to a 1 percent withholding tax. bir revenue regulation 16 2023, issued last december 21, said the withholding tax will apply to one half of…. Under this catch all provision, private corporations classified as top withholding agents (twas) are required to withhold 1% and 2% ewt on their local resident suppliers of goods and services, respectively, if the local purchases are not covered by the other ewt rates. Last december 21, 2023, bir issued revenue regulations no. 16 2023 (rr no. 16 2023), imposing a one percent withholding tax (wht) on half of the gross remittances that e marketplace operators and digital financial services providers (dfsps) pay to online sellers or partner merchants. Bir revenue regulation no. 16 2023 officially imposes a one percent withholding tax on gross remittances made by operators of electronic marketplaces and digital financial services providers.

Jual Jasa Pembuatan Simulasi Dan Program Arduino Shopee Indonesia Manila – the bureau of internal revenue (bir) has announced that online merchants with earnings amounting to more than php500,000 annually are now subject to a 1 percent withholding tax. bir revenue regulation 16 2023, issued last december 21, said the withholding tax will apply to one half of…. Under this catch all provision, private corporations classified as top withholding agents (twas) are required to withhold 1% and 2% ewt on their local resident suppliers of goods and services, respectively, if the local purchases are not covered by the other ewt rates. Last december 21, 2023, bir issued revenue regulations no. 16 2023 (rr no. 16 2023), imposing a one percent withholding tax (wht) on half of the gross remittances that e marketplace operators and digital financial services providers (dfsps) pay to online sellers or partner merchants. Bir revenue regulation no. 16 2023 officially imposes a one percent withholding tax on gross remittances made by operators of electronic marketplaces and digital financial services providers.