Mining M A In 2023 Gold Eagle Take the third quarter of 2023, when there were 323 m&a announcements totaling $14 billion, according to globaldata’s deals database. the biggest one was the $3.4b minority acquisition of vale base metals by engine no. 1 and manara minerals investment. S&p global commodity insights reports on m&a activity in 2023 in the metals and mining industry with a minimum deal value of $10 million and 1 million ounces of gold or 100,000 metric tons of base metal in acquired reserves and resources (r&r).

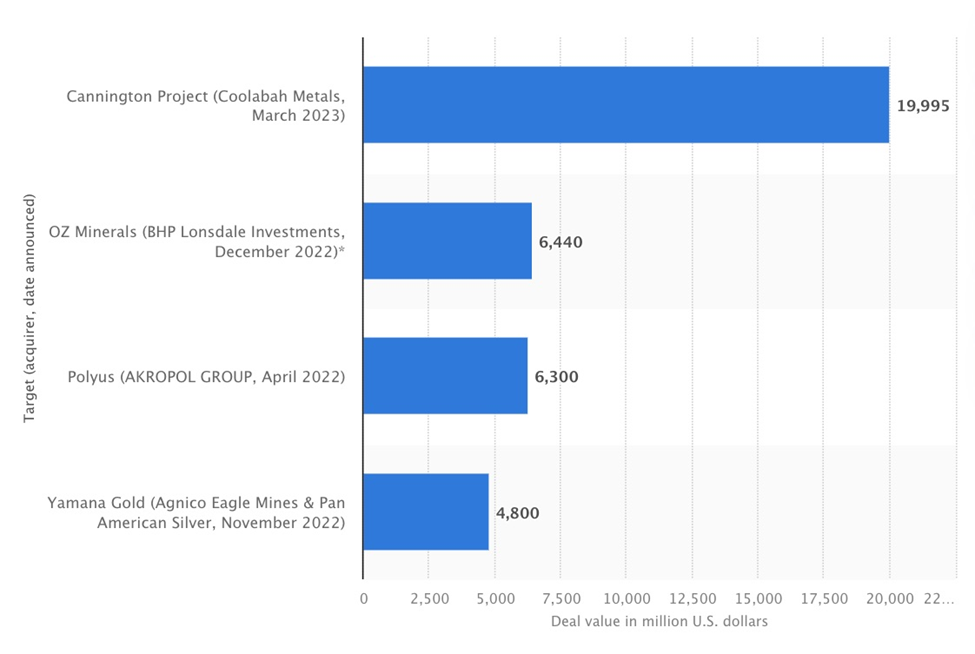

Mining M A In 2023 Gold Eagle While gold companies continue to make up a large proportion of mining m&as, the driving force of inorganic growth in recent years has been the pursuit of critical minerals. this has motivated deals from tier 1 miners such as bhp, rio tinto and south32, while igo recently boosted its nickel exposure by acquiring western areas. #1) newmont newcrest mining: the $15 billion deal adds five active mines and two advanced projects to newmont’s portfolio. the enlarged newmont will have gold assets in north and south america, africa, australia and papua new guinea. it will also expand its exposure to copper. #2) bhp group oz minerals: bhp acquired oz minerals for $6.4 billion. Mining sector m&a closed 2022 with a flurry of activity that appears set to continue into 2023. for instance, newmont corporation, the world’s largest gold miner, has approached newcrest mining, australia’s largest gold miner, with a non binding offer of us$17 billion to acquire it. Explore mining stocks poised for growth: discover m&a trends, undervalued opportunities, and the potential of gold, copper, and critical minerals. learn about the $35.1 billion in deals shaping the sector and find hidden gems for investment in 2025.

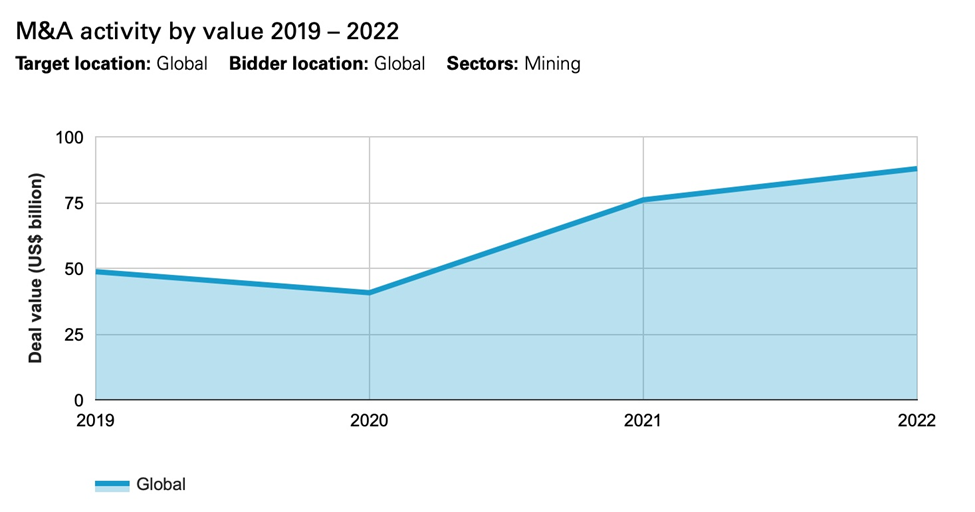

2023 American Gold Eagle Gold Eagle Guide Mining sector m&a closed 2022 with a flurry of activity that appears set to continue into 2023. for instance, newmont corporation, the world’s largest gold miner, has approached newcrest mining, australia’s largest gold miner, with a non binding offer of us$17 billion to acquire it. Explore mining stocks poised for growth: discover m&a trends, undervalued opportunities, and the potential of gold, copper, and critical minerals. learn about the $35.1 billion in deals shaping the sector and find hidden gems for investment in 2025. Gold mining companies are ramping up m&a activity as record gold prices boost the free cash flow they can use to make deals. as older mines become depleted and mining costs rise, quickly. The mineralized system is still open in all directions, and intercepts of 5.75 g t gold over 4m, 21.4 g t gold over 1m, 5.86 g t gold over 3.5m and 9.36 g t gold over 3m have been returned. The recent rise in global mining m&a activity is set to continue into 2024 and beyond as part of the global push towards green energy, fitch ratings predicts in a new report. As the christmas holiday approaches, bulls are celebrating some continued strength in gold and silver markets. gold is currently up 1.7% for the week to bring spot prices to $2,065 per ounce. the monetary metal has a chance of finishing out the year next friday at a new all time high.

2023 1 Oz Gold American Eagle Defythegrid Gold mining companies are ramping up m&a activity as record gold prices boost the free cash flow they can use to make deals. as older mines become depleted and mining costs rise, quickly. The mineralized system is still open in all directions, and intercepts of 5.75 g t gold over 4m, 21.4 g t gold over 1m, 5.86 g t gold over 3.5m and 9.36 g t gold over 3m have been returned. The recent rise in global mining m&a activity is set to continue into 2024 and beyond as part of the global push towards green energy, fitch ratings predicts in a new report. As the christmas holiday approaches, bulls are celebrating some continued strength in gold and silver markets. gold is currently up 1.7% for the week to bring spot prices to $2,065 per ounce. the monetary metal has a chance of finishing out the year next friday at a new all time high.

Asset Strategies International 2023 Gold American Eagle 1 10 Oz The recent rise in global mining m&a activity is set to continue into 2024 and beyond as part of the global push towards green energy, fitch ratings predicts in a new report. As the christmas holiday approaches, bulls are celebrating some continued strength in gold and silver markets. gold is currently up 1.7% for the week to bring spot prices to $2,065 per ounce. the monetary metal has a chance of finishing out the year next friday at a new all time high.