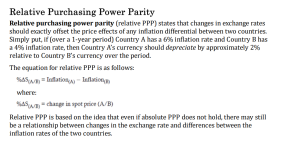

Relative Purchasing Power Parity Ppp Calculator Purchasing power parity (ppp) is an economic theory and a technique used to determine the relative value of currencies, estimating the amount of adjustment needed on the exchange rate between countries in order for the exchange to be equivalent to (or on par with) each currency’s purchasing power. Purchasing power parity (ppp) is a popular macroeconomic analysis metric used to compare economic productivity and standards of living between countries. ppp involves an economic theory.

Relative Purchasing Power Parity Ppp Calculator Dive into the economics behind purchasing power parity (ppp) in this video exploring its macro implications through absolute ppp and relative ppp. we begin w. Purchasing power parity (ppp) is a powerful tool, but it comes in two types: absolute ppp and relative ppp. understanding the difference is crucial for accurate economic comparisons across borders. absolute ppp: imagine a world where identical goods cost the same everywhere, regardless of currency. Purchasing power parity (ppp) [1] is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currencies. ppp is effectively the ratio of the price of a market basket at one location divided by the price of the basket of goods at a different location. The relationship between the absolute and relative purchasing power parity (ppp) theories is restated theoretically. then the relative ppp theory is tested using the gdp deflator and the cost of living as price level concepts.

Purchasing Power Parity Ppp Purchasing power parity (ppp) [1] is a measure of the price of specific goods in different countries and is used to compare the absolute purchasing power of the countries' currencies. ppp is effectively the ratio of the price of a market basket at one location divided by the price of the basket of goods at a different location. The relationship between the absolute and relative purchasing power parity (ppp) theories is restated theoretically. then the relative ppp theory is tested using the gdp deflator and the cost of living as price level concepts. The two types of ppp are absolute parity and relative parity. ppp has many advantages, like remaining stable over the years and measuring a nation's wealth, cost of living, and purchasing power easily without accounting for gross domestic product. What is the difference between absolute and relative purchasing power parity? absolute ppp compares the price levels of goods across countries, while relative ppp looks at the rate of change in price levels or inflation rates over time. Purchasing power parity (ppp) is an adjustment for prices that reflects the number of goods the consumers can buy in their own country using their own currency and consistent with their own living standards and per capita income. Purchasing power parity (ppp) compares currencies using a common basket of goods. the basic absolute ppp formula is: ppp exchange rate = price of basket in country a price of basket in country b. this shows the exchange rate based on the relative price of a basket of goods between countries. 2. how do you calculate ppp with inflation rates?.

Purchasing Power Parity Ppp The two types of ppp are absolute parity and relative parity. ppp has many advantages, like remaining stable over the years and measuring a nation's wealth, cost of living, and purchasing power easily without accounting for gross domestic product. What is the difference between absolute and relative purchasing power parity? absolute ppp compares the price levels of goods across countries, while relative ppp looks at the rate of change in price levels or inflation rates over time. Purchasing power parity (ppp) is an adjustment for prices that reflects the number of goods the consumers can buy in their own country using their own currency and consistent with their own living standards and per capita income. Purchasing power parity (ppp) compares currencies using a common basket of goods. the basic absolute ppp formula is: ppp exchange rate = price of basket in country a price of basket in country b. this shows the exchange rate based on the relative price of a basket of goods between countries. 2. how do you calculate ppp with inflation rates?.