Comprehensive Accounting Review Center Pdf Financial Statement Canada help for amazon sellers if you are already a seller, sign in to search all of our help content and self service tools. Hi, i am a new seller on amazon.ca. i am already registered for gst hst but not for pst in the 4 provinces (bc, sask, manitoba, quebec). i was trying to setup my seller central in a way that amazon can collect gst hst on my behalf. however, it also asks me if i want to collect pst. now i am not currently registered for pst in any of the provinces. am i still obligated to register for and.

Accounting For Trusts Students Notes Pdf Trust Law English Trust Law We are pleased to share that we're adding a new fulfillment centre to our canadian network on october 1, 2023. to make sure that our customers continue to get fast deliveries during the holiday season, send all your shipments to yxu1, just like you do for other canadian fulfillment centers. make sure to keep this information handy and update your internal address systems, if required. here are. Why is amazon.ca requiring this document? to comply with canadian law, amazon canada needs to verify your business and personal information before you can receive proceeds from your amazon.ca sales. Hello, i recently opened a seller account on amazon canada, and in the business information section, i was asked to submit a document called a self attestation letter. How do we update the tax codes and where are the tax codes??? @daryl amazon @sunnie amazon @jurgen amazon @josh amazon as previously communicated, the canadian government has announced temporary relief of goods and services tax and harmonized sales tax (gst hst) for certain products that are sold between december 14, 2024, and february 15, 2025. action required by december 14: check if your.

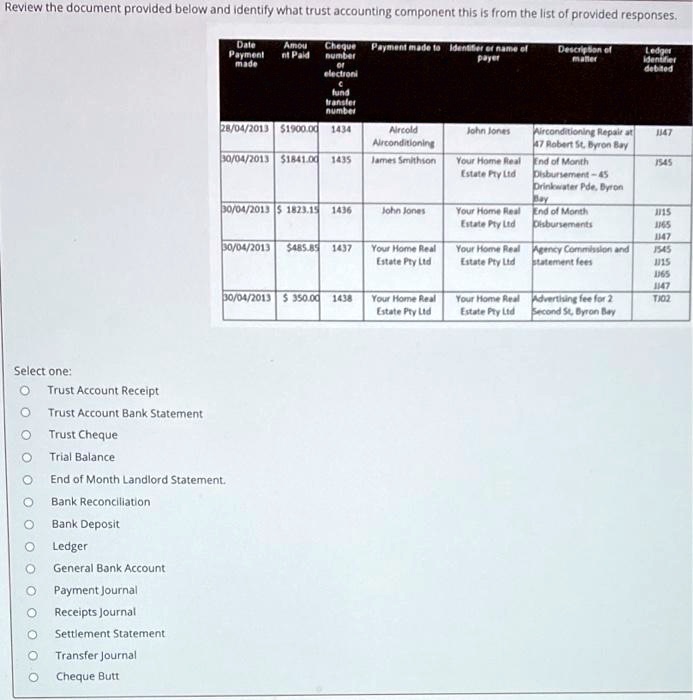

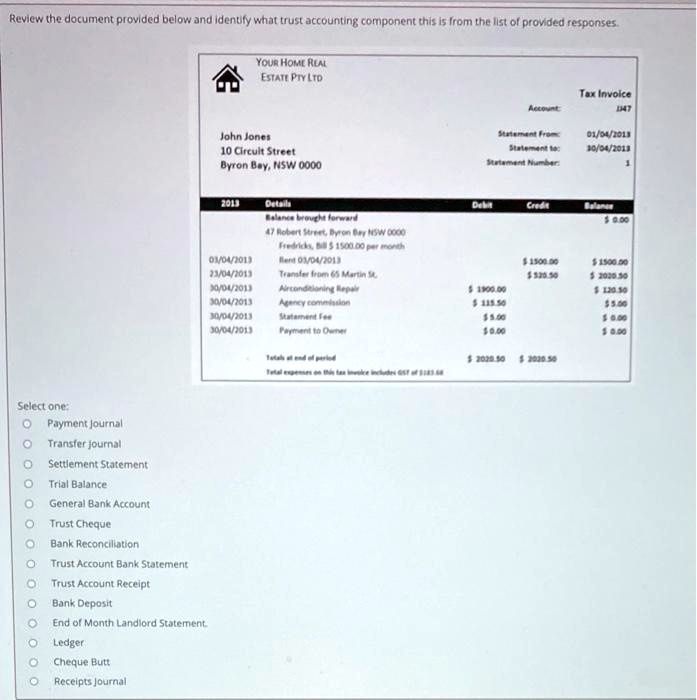

Solved Review Document And Identify What Trust Accounting Component Hello, i recently opened a seller account on amazon canada, and in the business information section, i was asked to submit a document called a self attestation letter. How do we update the tax codes and where are the tax codes??? @daryl amazon @sunnie amazon @jurgen amazon @josh amazon as previously communicated, the canadian government has announced temporary relief of goods and services tax and harmonized sales tax (gst hst) for certain products that are sold between december 14, 2024, and february 15, 2025. action required by december 14: check if your. The canada tax and regulatory considerations help page includes current canadian tax rates. tax calculation service sourcing and product taxability are controlled by your tax setting inputs, our tax methodology, and tax calculation services terms. I am setting up my amazon sellers account. amazon is asking me to submit the company's registration extract. can anyone please guide me through what this document is? initially, i uploaded the "registration confirmation notice i received from cra (canada revenue agency)." amazon did not accept it and asked me to provide a business registration certificate. then, i registered the business name. Dear amazon team, 1) could you please provide link reference to the regulations where canadian government is legally requiring the verification, and rationale behind it. 2) the requirements appear to be similar to the requirements for opening a business bank account in canada or applying for a commercial loan. did amazon become a bank in canada? 3) why would a business need this verification. For sellers on amazon.ca who ship goods to customers located anywhere in canada from a location in canada (domestic transaction), and who have not registered their gst hst registration with amazon: amazon will be responsible for calculating, collecting, and remitting gst hst on your domestic transactions starting july 1, 2021.

Solved Text Review The Document Provided Below And Identify What The canada tax and regulatory considerations help page includes current canadian tax rates. tax calculation service sourcing and product taxability are controlled by your tax setting inputs, our tax methodology, and tax calculation services terms. I am setting up my amazon sellers account. amazon is asking me to submit the company's registration extract. can anyone please guide me through what this document is? initially, i uploaded the "registration confirmation notice i received from cra (canada revenue agency)." amazon did not accept it and asked me to provide a business registration certificate. then, i registered the business name. Dear amazon team, 1) could you please provide link reference to the regulations where canadian government is legally requiring the verification, and rationale behind it. 2) the requirements appear to be similar to the requirements for opening a business bank account in canada or applying for a commercial loan. did amazon become a bank in canada? 3) why would a business need this verification. For sellers on amazon.ca who ship goods to customers located anywhere in canada from a location in canada (domestic transaction), and who have not registered their gst hst registration with amazon: amazon will be responsible for calculating, collecting, and remitting gst hst on your domestic transactions starting july 1, 2021.

Solved Review The Document Provided Below And Identify What Trust Dear amazon team, 1) could you please provide link reference to the regulations where canadian government is legally requiring the verification, and rationale behind it. 2) the requirements appear to be similar to the requirements for opening a business bank account in canada or applying for a commercial loan. did amazon become a bank in canada? 3) why would a business need this verification. For sellers on amazon.ca who ship goods to customers located anywhere in canada from a location in canada (domestic transaction), and who have not registered their gst hst registration with amazon: amazon will be responsible for calculating, collecting, and remitting gst hst on your domestic transactions starting july 1, 2021.