Tax Inclusive Rate In Invoice In Tally Erp Ds Software Best And Set allow inclusive of tax for stock items to yes. this refers in conformity with the quantity of tax paid so a share of the after tax value; profits anxiety rates are fast expressed into tax inclusive terms. When defining the price of the item you can include the tax rate. 1. go to gateway of tally > inventory info. > stock items > create alter > f12: configure . 2. set allow inclusive of tax for stock items to yes . 3. press ctrl a to go to the stock item alteration screen. 4. set is inclusive of duties and taxes? to yes . 5.

Inclusive Exclusive Tax For Tax Invoice For Tally Erp 9 Tally Data Assign inclusive tax rate of the item in incl. of tax rate column, tallyprime will automatically calculate the items value after deducting gst as per given sale invoice with example. Release 6.5.3 of tally.erp 9 allows you to print inclusive of vat item rate in a sales invoice. it provides you with the option to record the inclusive rate manually during the transaction and. Assign inclusive tax rate of the item in incl. of tax rate column, tally.erp9 will automatically calculate the items value after deducting gst as per given sale invoice with example. The document outlines the benefits and steps for enabling the rate inclusive of taxes column in tally, which simplifies sales by avoiding manual tax calculations and is particularly useful for retail businesses. it provides a step by step guide to activate this feature in the sales voucher and record transactions with gst inclusive prices.

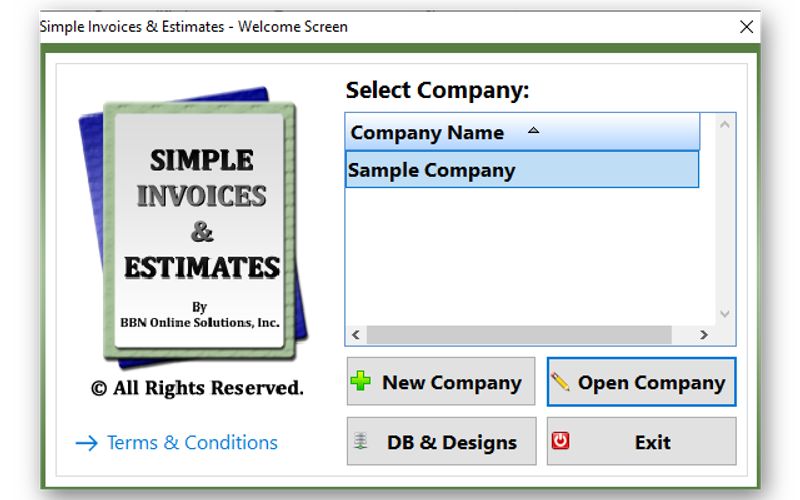

Tally Erp 9 Alternatives And Similar Software Alternativeto Assign inclusive tax rate of the item in incl. of tax rate column, tally.erp9 will automatically calculate the items value after deducting gst as per given sale invoice with example. The document outlines the benefits and steps for enabling the rate inclusive of taxes column in tally, which simplifies sales by avoiding manual tax calculations and is particularly useful for retail businesses. it provides a step by step guide to activate this feature in the sales voucher and record transactions with gst inclusive prices. Inclusive & exclusive tax tdl for tax invoice in tally erp 9 here is the preview of this tdl file how to install the tdl file in tally step 1. go to gateway of tally. step 2. then press ctrl alt t button step 3. now press f4 button or click on “manage local tdl” button step 4. now do “yes” to “loan tdl files on startup” option step 5. You can implement this add on in both local purchases on which cgst and sgst and interstate purchase on which igst . all you have to do is create ledgers related to purchases , before making purchase entry in tally. that is all it takes to integrate this feature into your tally. While issuing sales invoice for above sale order of item a, above rate is treated as basic & fetched to rate column of sales invoice instead of rate (inclv of tax) column. we need rate entered in sale order to be treated as tax inclusive. How to add rate inclusive of tax on sales invoice in tally prime | including gst rate on invoice #tallycourse #tallyprime #tallytutorial #accounting #rate inclusive of tax.