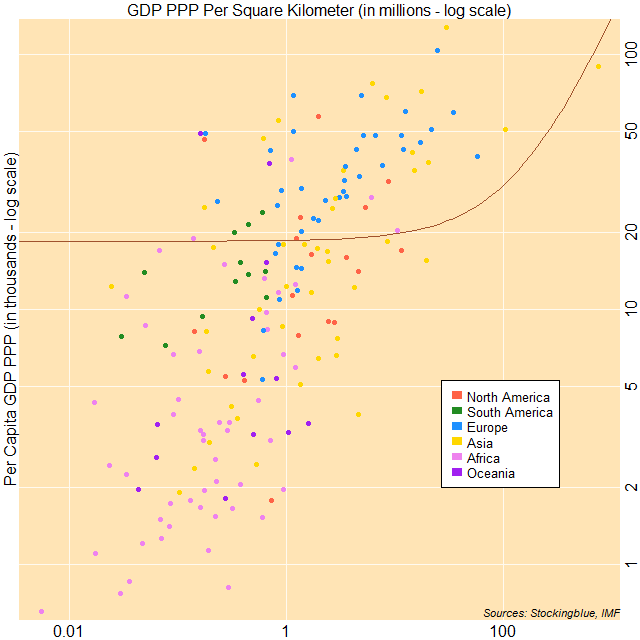

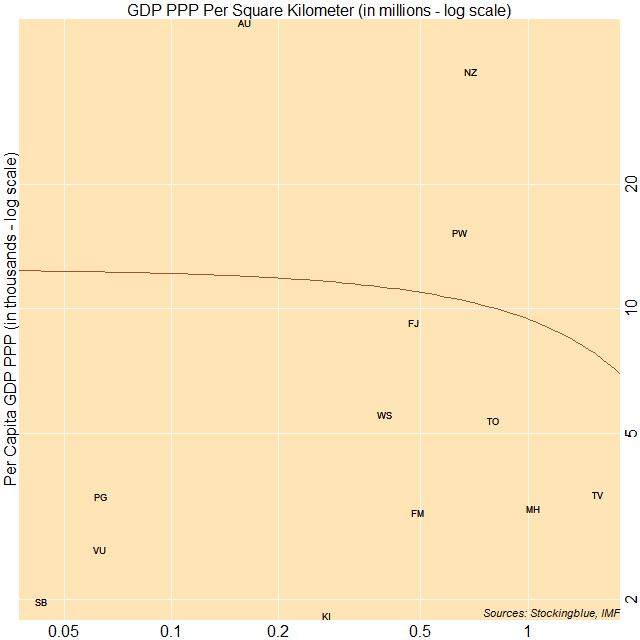

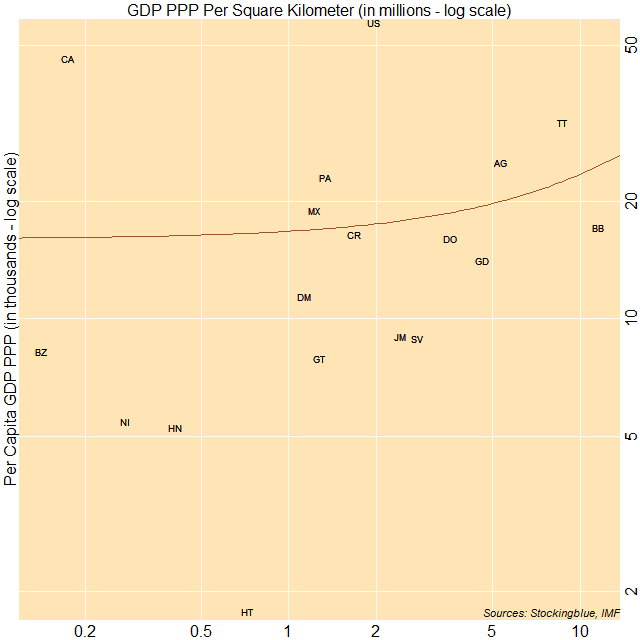

The Correlation Between Gdp Ppp Per Capita And Gdp Ppp Per Area The correlation between per capita gross domestic product based on purchasing power parity (gdp ppp) and gdp ppp per area worldwide is moderately weak. the three largest economies on a per capita basis have a high per area gdp relative to other countries. Many of the countries with the lowest ppp adjusted income per capita are located in which of the following areas? gdp divided by number of "workers," meaning those in employment; gives us a better picture of how much each worker produces on average by excluding those who do not work.

The Correlation Between Gdp Ppp Per Capita And Gdp Ppp Per Area In If the ppp exchange rate between the two countries is 0.8 (meaning that the currency of country b is undervalued compared to country a), we can calculate the ppp adjusted gdp per capita for both countries. A look at how gdp per capita in $us gives different values when measured at purchasing power parity. gdp at purchasing power parity (ppp) takes into account variations in living costs. Ppps control for the differences in price levels between economies and equalize the purchasing power of currencies. in this way, ppps show the relative price of a given basket of goods and services in each of the economies being compared with reference to a base economy. We find strong evidence of a long run relationship among the chosen variables. the co integration equation reveals positive relationship between gdp ppp per capita and the real exchange rate, real interest rate, and money supply and a negative relationship between gdp ppp and cpi.

The Correlation Between Gdp Ppp Per Capita And Gdp Ppp Per Area In Ppps control for the differences in price levels between economies and equalize the purchasing power of currencies. in this way, ppps show the relative price of a given basket of goods and services in each of the economies being compared with reference to a base economy. We find strong evidence of a long run relationship among the chosen variables. the co integration equation reveals positive relationship between gdp ppp per capita and the real exchange rate, real interest rate, and money supply and a negative relationship between gdp ppp and cpi. Purchasing power parity (ppp) and income per capita are two critical economic indicators that economists use to assess the relative economic strength and living standards of countries. There has been a growing tendency to look at aggregate gdp (at ppp) as an indicator of the relative size or strength of whole economies—as a factor, for instance, in assessing geopolitical power. china’s gdp at ppp recently passed that of the united states. There are 61 countries for which the relative difference between the icp numbers and world bank’s ppp gni per capita exceeds 25 %, and one of these is negative. the largest difference is 196.8 % for iraq and the smallest is −45.0 % for comoros. The correlation between per capita gross domestic product based on purchasing power parity (gdp ppp) and gdp ppp per area worldwide is moderately weak. the three largest economies on a per capita basis have a high per area gdp relative to other countries.