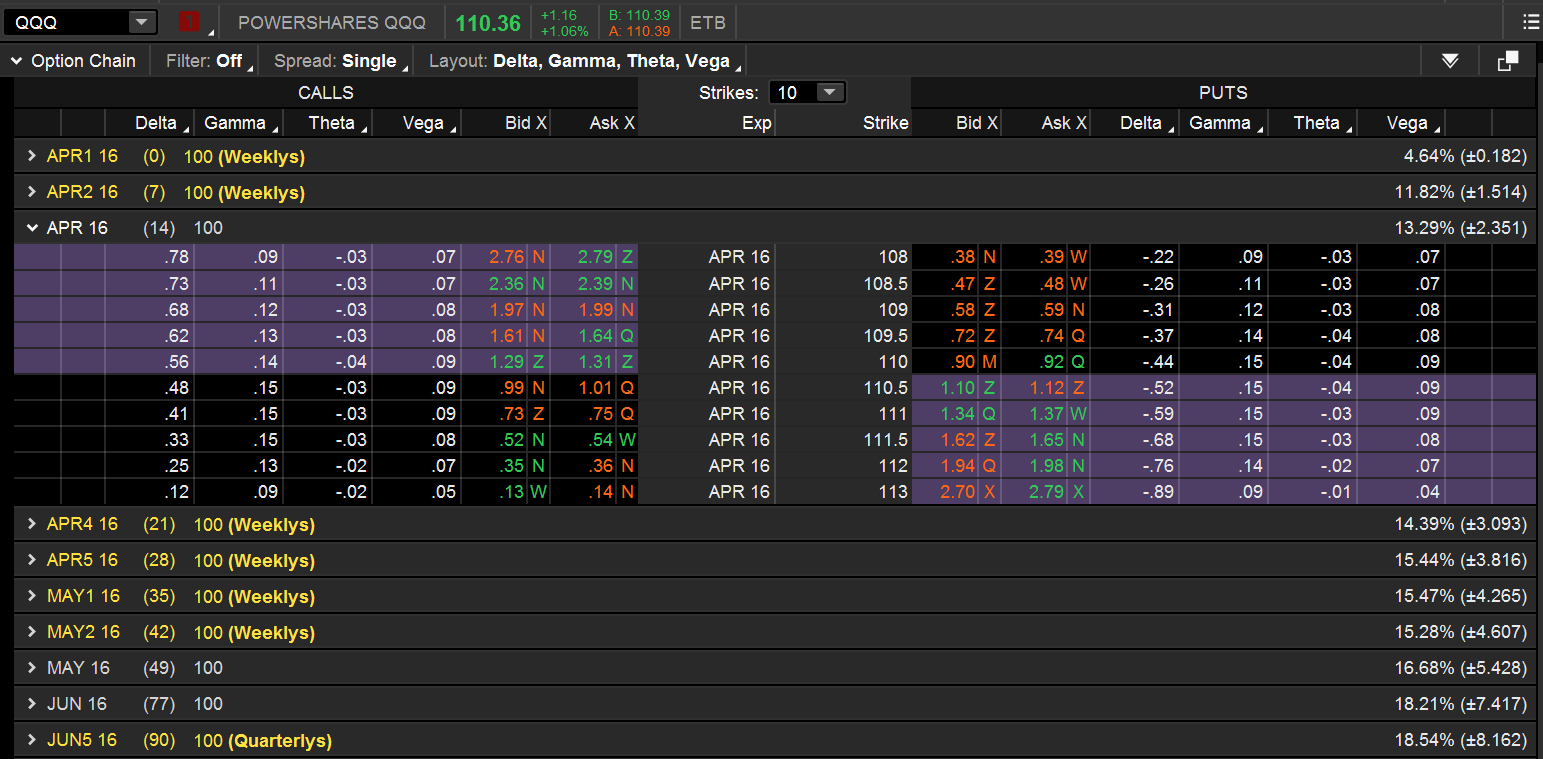

Understanding Options Trading Pdf Put Option Option Finance We’ll be looking at options on stocks, etfs, and indexes (the underlying securities) primarily because they are the most popular and the easiest to understand and put into your wealth building plan. Options are derivatives of financial securities—their value depends on the price of some other asset. examples of derivatives include calls, puts, futures, forwards, swaps, and.

Trading With Options The Diversified Trader This guide breaks down how options work from both perspectives, exploring the mechanics, opportunities, and risks involved for buyers and sellers. by understanding the dynamics of options trading. Engaged investors and options curious traders who want to learn how to leverage derivatives effectively need more education. as an options broker for more than 15 years, here are a few. Both seasoned and new investors are embracing options trading, helping contribute to its explosive growth. these two groups are realizing the flexibility that options provide: investors can. Quick take: the top strategy for long term options trading is to diversify your portfolio across different types of assets and apply various options strategies to mitigate risk and achieve long term gains. this involves regularly reviewing your portfolio, monitoring market conditions, and being patient and calculated in your decision making.

Trading With Options The Diversified Trader Both seasoned and new investors are embracing options trading, helping contribute to its explosive growth. these two groups are realizing the flexibility that options provide: investors can. Quick take: the top strategy for long term options trading is to diversify your portfolio across different types of assets and apply various options strategies to mitigate risk and achieve long term gains. this involves regularly reviewing your portfolio, monitoring market conditions, and being patient and calculated in your decision making. Options trading offers a spectrum of strategies for traders to capitalize on market movements while managing risk effectively. however, success in options trading hinges on education and understanding the nuances of the market. There's no doubt that diversification is important when building an options portfolio. but we need to focus on diversifying the underlying securities that we are trading vs the strategies we deploy, since we know that we make the most money trading as net option sellers. Diversification in options trading reduces your exposure to single position losses through strategic allocation across different: market volatility affects different options positions differently. a diversified portfolio captures upside potential while limiting downside risk through offsetting positions. Understanding option trading basics. 2. what are stock options? 3. difference between call options and put options. 4. how stock options function in the options market. 5. exploring option trading strategies. 6. covered calls. 7. protective puts. 8. straddles. 9. navigating the options market. 10. analysing option contracts. 11.

Understanding Options Trading The Diversified Trader Options trading offers a spectrum of strategies for traders to capitalize on market movements while managing risk effectively. however, success in options trading hinges on education and understanding the nuances of the market. There's no doubt that diversification is important when building an options portfolio. but we need to focus on diversifying the underlying securities that we are trading vs the strategies we deploy, since we know that we make the most money trading as net option sellers. Diversification in options trading reduces your exposure to single position losses through strategic allocation across different: market volatility affects different options positions differently. a diversified portfolio captures upside potential while limiting downside risk through offsetting positions. Understanding option trading basics. 2. what are stock options? 3. difference between call options and put options. 4. how stock options function in the options market. 5. exploring option trading strategies. 6. covered calls. 7. protective puts. 8. straddles. 9. navigating the options market. 10. analysing option contracts. 11.

Understanding Options Trading The Diversified Trader Diversification in options trading reduces your exposure to single position losses through strategic allocation across different: market volatility affects different options positions differently. a diversified portfolio captures upside potential while limiting downside risk through offsetting positions. Understanding option trading basics. 2. what are stock options? 3. difference between call options and put options. 4. how stock options function in the options market. 5. exploring option trading strategies. 6. covered calls. 7. protective puts. 8. straddles. 9. navigating the options market. 10. analysing option contracts. 11.