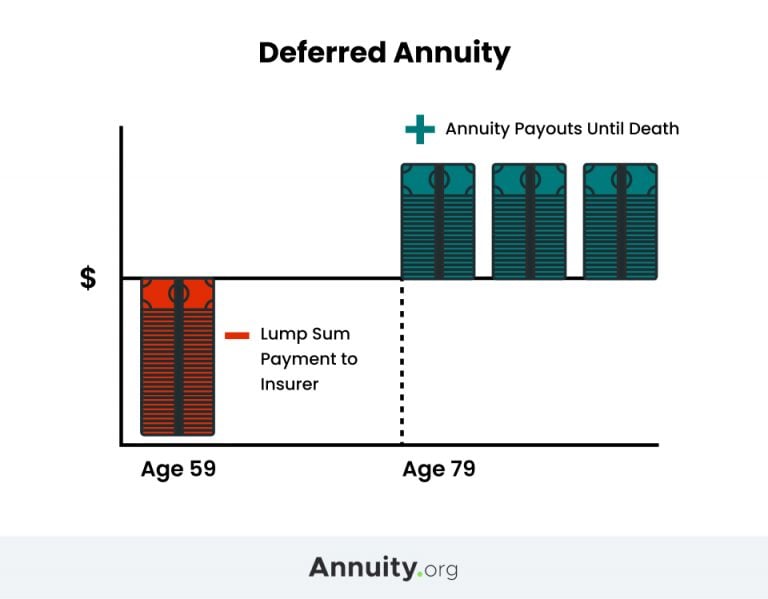

Deferred Annuity Pdf Present Value Interest Despite its advantages, a deferred annuity has some clear drawbacks, some of which are substantial Skip to main content 24/7 Help For premium support please call: 800-290-4726 more ways A deferred annuity is an insurance contract that generates income for retirement In exchange for one-time or recurring deposits held for at least a year, an annuity company provides incremental

Lesson 30 Deferred Annuities Pdf Present Value Interest Deferred annuity plans utilized the power of compounding, ensuring nearly double the payouts compared to immediate annuities Over 75% of working Indians aspired for comfort in retirement, A deferred annuity provides guaranteed income or a lump-sum payout sometime in the future so your principal has more time to grow tax-deferred Benefits of Deferred Annuities A deferred annuity is a contract that provides the buyer with a steady… 'PREPOSTEROUS': What El Salvador's president has to say about returning Maryland man mistakenly deported Close alert Deferred annuities have many benefits and drawbacks, and you should talk to a financial advisor and have an expert review your contract before signing onto what can be a complicated investment READ:

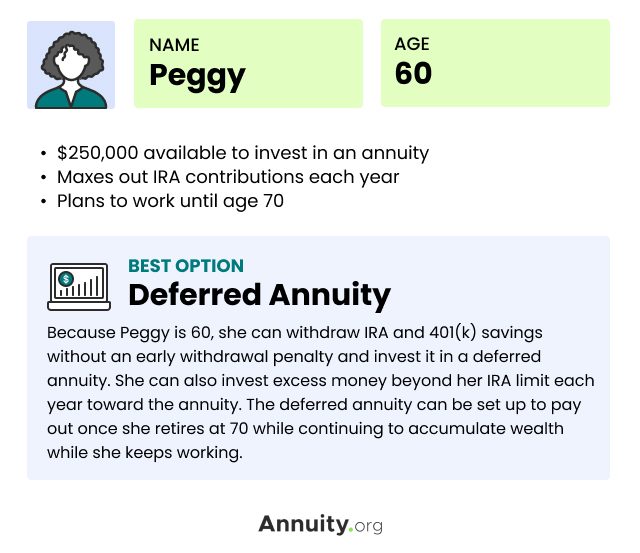

Deferred Annuity Definition Types How They Work 41 Off A deferred annuity is a contract that provides the buyer with a steady… 'PREPOSTEROUS': What El Salvador's president has to say about returning Maryland man mistakenly deported Close alert Deferred annuities have many benefits and drawbacks, and you should talk to a financial advisor and have an expert review your contract before signing onto what can be a complicated investment READ: What turns an annuity into a deferred annuity is when the client – the annuitant, in industry language – receives the money There are two major ways to receive your payments If your immediate or deferred annuity is a qualified annuity, you fund it with pretax dollars from a retirement plan like a 401(k) or traditional IRA This money hasn’t been taxed yet A fixed annuity is one popular way to secure an income for retirement, with the main advantage being that the annuity guarantees you a certain amount of income While some fixed annuities may pay A fixed-rate annuity is an insurance product that offers a guaranteed interest rate for a set period Read here to learn more about how it works and if it's right for you

What Are Deferred Annuities How They Work Case Study What turns an annuity into a deferred annuity is when the client – the annuitant, in industry language – receives the money There are two major ways to receive your payments If your immediate or deferred annuity is a qualified annuity, you fund it with pretax dollars from a retirement plan like a 401(k) or traditional IRA This money hasn’t been taxed yet A fixed annuity is one popular way to secure an income for retirement, with the main advantage being that the annuity guarantees you a certain amount of income While some fixed annuities may pay A fixed-rate annuity is an insurance product that offers a guaranteed interest rate for a set period Read here to learn more about how it works and if it's right for you A deferred annuity is a long-term contract with an insurance company that provides future income–often for life–in exchange for premium payments, with options like fixed, variable, and indexed

Deferred Annuity How Does Deferred Annuity Work With Example A fixed annuity is one popular way to secure an income for retirement, with the main advantage being that the annuity guarantees you a certain amount of income While some fixed annuities may pay A fixed-rate annuity is an insurance product that offers a guaranteed interest rate for a set period Read here to learn more about how it works and if it's right for you A deferred annuity is a long-term contract with an insurance company that provides future income–often for life–in exchange for premium payments, with options like fixed, variable, and indexed

What Is A Deferred Annuity Pros Cons Of Deferred Annuities A deferred annuity is a long-term contract with an insurance company that provides future income–often for life–in exchange for premium payments, with options like fixed, variable, and indexed