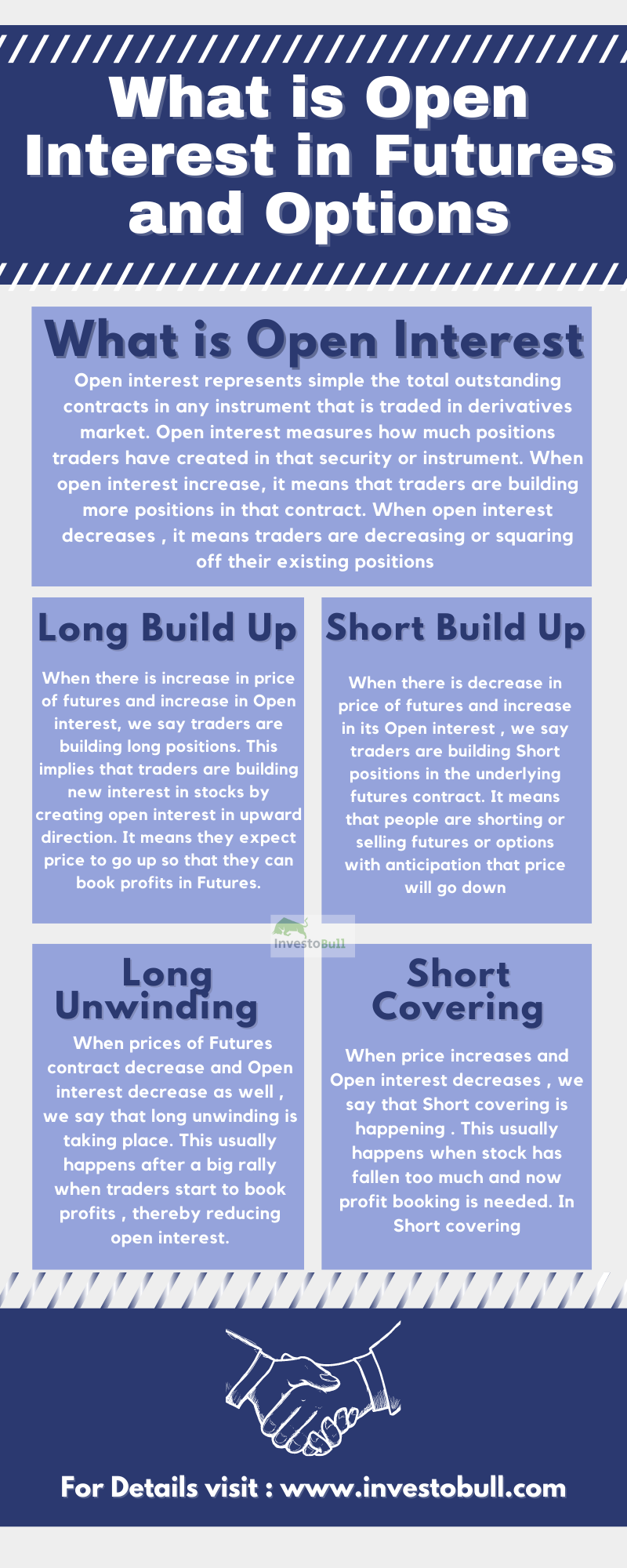

Long Buildup Short Buildup Long Short Mean People Long buildup (lb) happens when a significant increase in open interest for a particular stock’s futures contracts gets paired with a price increase. this shows that traders aggressively take long bets in anticipation of a future price increase. Long buildup: when traders are building long positions, it essentially means people are taking positions assuming the price will go up. this is characterized by an increase in open interest and increase in price. short buildup: when traders are building short positions, it means people are taking short positions, assuming the price will go down.

What Is Open Interest In Futures And Options Open interest is simply the number of open contracts that are held by market participants. open interest represents how bullish or bearish traders are on a particular asset. when open interest is rising, it generally means that traders are bullish and getting ready to push prices higher. This article will learn some of the essential points of futures and options, including long build up. but before we start discussing long build up, we also need to understand open interest, short build up, and many other terms. Long buildup – betting the price will go up. a long buildup happens when traders are buying more of a futures or options contract, and the price is going up, along with rising open interest. open interest means the number of active contracts. if both price and open interest are rising, it means more people are entering buy positions. What is a short buildup? a short buildup is when traders increase their short positions, expecting the price of an asset to fall. in technical terms, this means that there is an increase in open interest (oi) accompanied by a decline in the asset's price. •rising open interest (oi): this indicates an increase in the number of outstanding contracts.

Long Buildup Short Buildup Futures And Option Open Interest Gainers Long buildup – betting the price will go up. a long buildup happens when traders are buying more of a futures or options contract, and the price is going up, along with rising open interest. open interest means the number of active contracts. if both price and open interest are rising, it means more people are entering buy positions. What is a short buildup? a short buildup is when traders increase their short positions, expecting the price of an asset to fall. in technical terms, this means that there is an increase in open interest (oi) accompanied by a decline in the asset's price. •rising open interest (oi): this indicates an increase in the number of outstanding contracts. Open interest refers to the total number of outstanding contracts in the futures or options market that have not been settled yet. in simpler terms, it is the total number of open positions (either long or short) that remain active and have not been squared off or expired. To summarize, futures open interest data is an extremely effective indicator of smart money’s intention & keeping a close track of it in the interest of every retail trader. Analysis for index futures, index options, stock options and stock futures.